Introduction

The financial plan shows how much money you will spend and how much money you hope to make in your new business. It helps you make sure you have enough money to run your business, and that you have thought about how you will cover your costs. Lenders and investors use the financial plan to help them decide if they want to give you a loan or invest in your business. It also helps you plan your business activities such as stocking supplies, purchasing equipment, and how much to charge for your service or product.

Financial Plan Sections

The financial plan includes several sections, which are covered in this chapter:

- Up-front cash needs

- Break-even analysis and pricing

- Sales forecast

- Cash flow statement

- Income statement

- Balance sheet

These sections build on one another, so if something in one section changes, you might have to go back and change other sections too.

Using the Financial Plan

A good financial plan will help your business succeed. It helps you evaluate how your business is doing. If there are differences between what you planned and what actually happens, you can use that information to make changes in terms of pricing, sales, or costs.

This chapter will help you complete the Financial Plan section on the Business Plan Outline you downloaded in Chapter 4.

Up-Front Cash Needs

To get started, you need to figure out your up-front cash needs. Up-front cash is the money needed to get a new business up and running. This includes the money you need to set up the business before it can open, and the money you need to run the business and cover expenses until your business earns a profit. It can often take several months to a year for a new business to build a strong customer base and become profitable.

Up-front cash needs are estimated for two types of costs:

- Pre-opening costs

- Post-opening costs

Pre-Opening Costs

Pre-opening costs are things you pay for while you’re getting your business set up and ready to open. These are the costs you estimated in the Start-up Costs Worksheet from Chapter 3: Business Feasibility. They include:

-

Production and service costs

- Materials and supplies to make your product or provide your service

- Inventory – finished products to sell (yours or someone else’s)

- Capital equipment – major equipment or other Items that typically last one year or longer

- General supplies – things you use in day-to-day business operations, but are not direct inputs for making your product

-

Physical space costs

- Furniture, displays, or shelving

- Remodeling costs - changing or getting your workspace ready for business

- Rent or mortgage payments for business set up and first month

- Utilities for business set up and first month

-

Marketing costs

- Creating marketing materials, such as logos, website, etc.

- Advertisements or promotions for grand opening

- Signs

-

Business management costs

- Business license, registrations, and permits

- Legal and accounting fees to set up your business

- Insurance

Update your Start-up Costs Worksheet from Chapter 3: Business Feasibility to estimate your pre-opening expenses.

Post-Opening Costs

Post-opening costs are things you pay for once your business is open. These are costs for things to run your business. They include:

- Inventory and ongoing production costs

- Wages

- Rent and utilities

- Capital equipment replacement or repair

- On-going advertising or marketing

- Ongoing expenses such as accounting services and insurance

- Other costs, such as taxes

Post-opening costs are often estimated on a monthly, quarterly, or yearly basis. For instance, wages, rent, and utilities are paid monthly, while insurance and taxes are often paid quarterly or two times per year. You will estimate post-opening costs in detail when developing a cash flow statement, which is described in a later section.

Funding

When you have enough money to pay for your pre- and post-opening expenses, with some money set aside for emergencies, your business is considered capitalized. This will allow your business to stay open until you start making a profit.

It can be hard to figure out how much up-front cash you need, but it is important to develop a good estimate. You need to know how much money you will have to use from your own savings, and how much money you’ll need to get from other funding sources. This estimate gets easier to figure out once you complete a cash flow statement, which you will do later in this chapter.

Sources of Cash

You can get funds to start your business from different places, such as:

- Personal savings

- Loans – bank loans, bank lines of credit, and loans from friends or family

- Investors – angel investors, venture capitalists, Vocational Rehabilitation, friends, or family

- Grants – small business incubators and other private or government grant programs

- Gifts – crowdfunding, friends, and family

Sources of cash are covered in greater detail in the Chapter 8: Resources section of this website. You may seek guidance from a small business development advisor for additional ideas.

Trade or Barter

One way to lower expenses is to trade or barter with other business owners or people. Think about what things other people could help you with, and what skills or talents you could offer in exchange. These could be professional skills related to your business, or other things that you’re good at but aren’t necessarily related to your business.

For example, you could exchange some home-cooked meals or babysitting for help with transporting and setting up your shelving units. Or, you could trade music lessons for bookkeeping assistance for your business. These types of trades will lower the amount of cash you have to come up with to pay your bills.

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Break-Even Analysis

A break-even analysis helps you figure out when your business will become profitable.

- First, it helps you figure out how much product or service you have to sell to cover your variable operating costs and fixed costs to break-even.

- Second, it helps you figure out how much more you need to sell to make a profit, not just cover your costs.

The break-even analysis is similar to the cost-evaluation exercise you completed in Chapter 3: Business Feasibility, but it is more detailed. This section will cover how to do a break-even analysis.

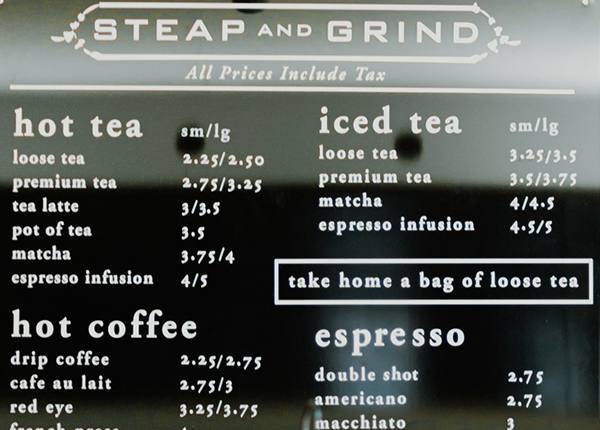

Pricing

The first step in conducting a break-even analysis is to consider the price you will charge for your product(s) or service(s). You will need to consider how much other businesses charge and how much customers are willing to pay.

How you price your product or service will affect how much you sell. When you charge more, you often sell less. Research about your industry can help you figure out how much customers typically pay.

Check out How to Price Your Small-Business Products and Services from the Small Business Association and How to Price Your Products from Inc.com to get some ideas.

Price Points

It is a good idea to consider how different prices will affect both sales and profits. When thinking about your pricing, identify a low, medium, and high price for your product. Once you start your business, you will have more information about how much customers will pay. Understanding how different prices affect sales will help you develop sales targets, or the amount you have to sell each month to cover costs.

Pricing a Service

Figuring out how to price a service is not always as easy as pricing a product. For example, it might be hard to calculate how much you spend on materials, labor, and fixed costs for a lawn care business. Instead, you can calculate a price for a unit of time, such as by the hour or by the project. To do this, research your industry for:

- Rates for comparable services

- Methods of billing ─ per hour or per project

- Who pays for materials – the customer or the business owner

Check out 5 Tips for Pricing Your Services When You’re Self-Employed from theselfemployed.com and What is Your Time Worth? How to Figure Out Your Hourly Rate from Handyman Startup for more tips on how to price a service.

Conducting a Break-Even Analysis

Once you settle on a price, or a few price options, you can conduct a break-even analysis. There are several steps to figure out how much you need to sell to cover your costs and earn a profit:

- Step 1: Estimate your variable and fixed operating costs

- Step 2: Estimate your gross profit for each unit of product or service sold

- Step 3: Determine your break-even point (units to make and sell to cover your operating and fixed costs)

- Step 4: Estimate additional units you need to sell to reach your profit goal

These steps are described below. Then, you can use a break-even analysis worksheet linked at the end of this section to help you figure out your own break-even point for three different prices.

Step 1: Variable and Fixed Operating Costs

The first step in a break-even analysis is to figure out your per unit variable costs and monthly fixed operating costs.

- Variable costs are how much it costs to produce your product or service, such as the materials, labor, and delivery costs to sell a unit of your product or service.

- Fixed operating costs are costs you always pay, even if you don’t sell anything. They are generally recurring costs, such as rent, utilities, or insurance.

You already estimated these costs in Chapter 6: The Operations Plan.

Step 2: Gross Profit Per Unit

To figure out your gross profit per unit, you need to determine the price you will charge for a unit of your product or service and subtract your variable costs for producing it.

price per unit – variable costs per unit = gross profit per unit

For example, if you sell a product for $20 and the cost to produce it is $12, your gross profit per unit is $8.

$20 (price per unit) - $12 (variable costs per unit) = $8 (gross profit per unit)

Step 3: Determining your Break-Even Point

When you sell enough units of your product or service to exactly cover your variable and fixed operating costs, this is called your break-even point. To figure out your break-even point, divide your fixed costs by your gross profit per unit.

fixed costs ÷ gross profit per unit = break-even point

Your business will break-even when the gross profit you bring in from sales exactly covers your fixed operating costs.

For example, if your fixed operating costs are $800 per month, and your gross profit per unit is $8, you would need to make and sell approximately 100 units of your product or service to break even.

$800 (monthly fixed costs) ÷ $8 (gross profit per unit) = 100 units sold (break-even point)

If you sell more than the break-even number (for example, if you sell 110 units), you will make a profit. If you sell less than the break-even point (for example, if you sell 90 units), you will lose money.

Step 4: Profit Sales Goals

If you want your business to grow, you can’t just break-even each month. You need to think about personal and long-term business goals, like earning money or expanding your business. A profit sales goal is the number of additional units of a product or service you need to sell to make a particular level of profit.

profit goal ÷ gross profit per unit = profit sales goal

For example, if you want to make $160 a month in profit (your profit goal), and your gross profit is $8, you would need to make and sell an additional 20 units of your product or service to reach your profit goal. Your profit goal is a dollar amount, and your profit sales goal is the number of extra units you need to sell to reach that goal.

$160 (profit goal) ÷ $8 (gross profit per unit) = 20 additional units sold (profit sales goal)

The following example shows all these steps for Jean’s Jewelry.

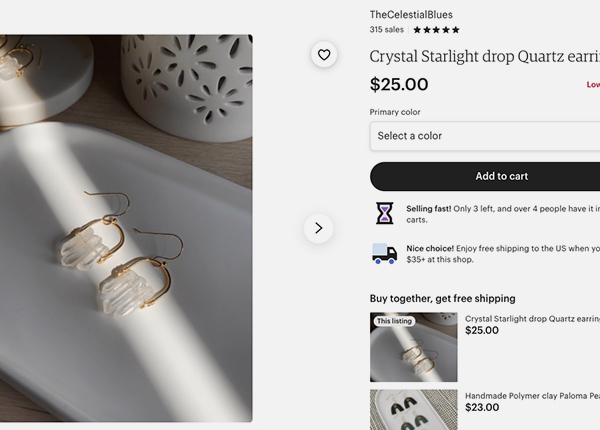

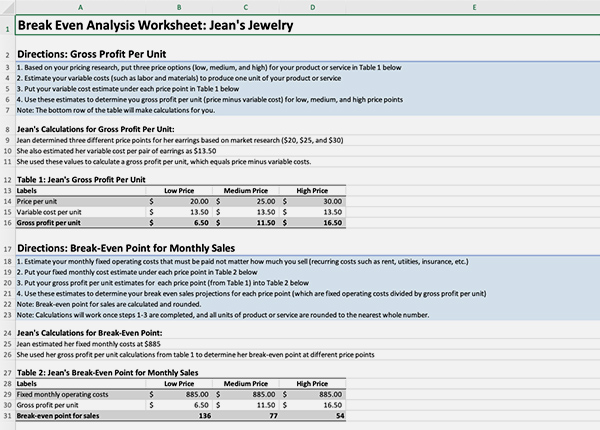

Example: Jean’s Jewelry

Jean is starting a jewelry-making business. She is starting with earrings, since they are relatively easy to make and sell. She does the following break-even analysis.

Step 1: Jean’s Variable and Fixed Operating Costs

Variable costs: Jean made a variable cost table to estimate her per unit variable costs to produce one pair of earrings in Table 1. She included per unit labor, materials, packaging, and shipping costs. She added these costs together and found that it will cost approximately $13.50 to make and sell one pair of earrings.

| Variable Costs | Amounts |

|---|---|

| Labor = ½ hour @ $9.00/hour | $4.50 |

| Silver | $5.00 |

| Semi-precious stones | $3.00 |

| Shipping costs | $0.75 |

| Box/packaging | $0.25 |

| Total variable costs per unit | $13.50 |

Fixed monthly operating costs. Next, Jean estimated her fixed monthly operating costs in Table 2. These include her rent, utilities, insurance, taxes, and other costs that she has to pay each month even if she doesn’t sell any of her earrings. Jean estimated her fixed monthly costs at $885. Note: Jean’s fixed costs include an owner’s draw, or an amount to help her cover some of her personal expenses.

| Fixed Operating Costs | Amounts |

|---|---|

| Rent (partial rent for home work space) | $200.00 |

| Utilities | $50.00 |

| Phone | $50.00 |

| Office supplies | $30.00 |

| Insurance | $25.00 |

| Advertising/promotion | $40.00 |

| Taxes | $40.00 |

| Owner's Draw | $300.00 |

| Craft fair expenses | $150.00 |

| Total fixed costs per month | $885.00 |

Step 2: Jean’s Gross Profit per Unit

Jean’s variable costs per pair of earrings is $13.50. In order to earn gross profit, she will need to charge more for a pair of earrings than it costs to make a pair. Jean did some market research about competitive jewelry prices at craft fairs. Based on this information, she estimated her gross profit per unit for three different price points ($20, $25, and $30 per pair of earrings) in Table 3 using this formula:

price per unit – variable costs per unit = gross profit per unit

| Row Labels | Low Price | Medium Price | High Price |

|---|---|---|---|

| Sales price per unit | $20 | $25 | $30 |

| Variable costs per unit | $13.50 | $13.50 | $13.50 |

| Gross profit per unit | $6.50 | $11.50 | $16.50 |

As the calculations show, charging a higher price increases the gross profit per unit sold. At a price of $20 per pair of earrings, gross profit per unit is $6.50. At $25 per pair of earrings, gross profit per unit is $11.50. And at $30 per pair of earrings, gross profit per unit is $16.50.

Step 3: Jean’s Break-even Point

Jean’s break-even point is how many pairs of earrings she must sell per month to cover both her variable and fixed costs. Depending on the price she charges and the gross profit she earns, Jean will have to make and sell different numbers of earrings to cover her monthly fixed costs.

She uses this calculation to figure out the break-even point for her low, medium, and high price points in Table 4:

fixed costs ÷ gross profit per unit = break-even point

| Row Labels | Low Price | Medium Price | High Price |

|---|---|---|---|

| Sales price per unit | $20 | $25 | $30 |

| Monthly fixed costs | $885.00 | $885.00 | $885.00 |

| Gross profit per unit | $6.50 | $11.50 | $16.50 |

|

Break-even point (number of units to sell) |

136 | 77 | 54 |

If Jean charges $20 per pair, she will need to make and sell 136 pairs of earrings to cover her fixed costs. If she charges $25 per pair, she will need to make and sell 77 pairs of earrings. If she charges $30 per pair, she will need to make and sell 54 pairs.

Keep in mind, although Jean may have to sell fewer pairs of earrings if she charges $30, she may also have fewer customers willing to pay that much.

Note: The number of units to sell are rounded to the nearest whole number, since it doesn’t make sense to sell 136.15 pairs of earrings.

Step 4: Jean’s Profit Sales Goals

Jean also wants to earn $150 in profit per month to pay down a loan and upgrade her equipment. She uses this calculation to figure out how many additional pairs of earrings she must sell to make a profit in Table 5:

profit goal ÷ gross profit per unit = profit sales goal

| Row Labels | Low Price | Medium Price | High Price |

|---|---|---|---|

| Sales price options | $20 | $25 | $30 |

| Profit goal per month | $150.00 | $150.00 | $150.00 |

| Gross profit per unit | $6.50 | $11.50 | $16.50 |

|

Profit sales goal (additional units to sell) |

23 | 13 | 9 |

If Jean sells her earrings at $20/pair, she will have to sell a total of 159 pairs of earrings each month (136 to break even and 23 to meet her profit goal).

If Jean sells her earrings at $25/pair, she will have to sell a total of 90 pairs of earrings each month (77 to break even and 13 to meet her profit goal).

If Jean sells her earrings at $30/pair, she will have to sell a total of 63 pairs of earrings each month (54 to break even and 9 to meet her profit goal).

Multiple Products

The example above assumes that Jean is only selling one product – earrings. The calculations can get a little more complicated when selling multiple products or services at different price points. For example, Jean may sell different types of jewelry, such as earrings, bracelets, and necklaces. In these situations, she would need to figure out gross profit per unit for each type of product or service, and determine the share of monthly fixed costs that would likely be covered by sales for each type of item.

Putting it all Together

We have included two break-even analysis worksheets (one for a single product with different price points, and one for making calculations for multiple products) for you to download, save, and use. Each worksheet is provided in two different formats – one for Microsoft Excel and one for Google Sheets.

- If you don’t have Microsoft Office Excel software, you can access a free version of Google Sheets spreadsheet software from Google Drive.

- If you use a screen reader, we suggest downloading a free version of NVDA screen reader software, which does a better job navigating the tables.

- We have also included examples of each worksheet for Jean’s Jewelry, that you can use to follow along with when completing your own break-even analysis.

Break-Even Analysis Worksheets (one product or service with low, medium and high price points):

- Break-even Analysis Worksheet (Excel)

- Break-even Analysis Worksheet (Google Sheets)

- Example: Jean’s Break-even Analysis (Excel)

- Example: Jean’s Break-even Analysis (Google Sheets)

Break-Even Analysis Worksheet – Multiple Products:

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Sales Forecast

The break-even analysis helps you set prices and sales goals. The sales forecast, on the other hand, describes what you think you will sell over a given period of time (typically 1 to 3 years). The numbers you plug into a sales forecast are based on information about other similar businesses, and are your best estimates. They are not your actual sales, because you have not been in business yet!

Developing a Sales Forecast

You can figure out your sales forecast in several different ways:

- Average sales: You can use average sales for similar businesses in similar locations to give you a ballpark idea about how much you might expect to sell.

- Market share: You can figure out your market share, or how many customers will come to your business as compared to other similar businesses.

- Sales breakdown: You can break down sales into months and account for differences in sales during business start-up or due to seasonal fluctuations.

If you can, use more than one of these ways to come up with your best estimate of future sales. The more information you gather to estimate sales, the better!

Once your business is up and running, your sales forecast will become more accurate because it will be based on your past year’s actual sales.

Average Sales

When you start a new business, you may not have a clear idea of what kind of sales to expect. Use average sales for similar businesses in similar locations to estimate your expected sales. However, don’t assume you will have average sales right away. Your sales will probably start out low and then increase over time as more customers learn about your business.

Check out this University of Minnesota Extension fact sheet: “How can I assess demand for a proposed business in my community?” for more information and instructions on how to use the Economic Census to estimate your potential sales.

Market Share

Market share for a business is the portion of the total sales, units, or customers that go to your business instead of other similar businesses. One way to figure out market share is to divide the total sales for all businesses in your area by how many sales your business made for the same time period.

Market share is hard to calculate when you are starting a new business, and it is unlikely that you will do it for your initial business plan. It is a better measure once your business has been operating for a time.

There are three ways to figure out your business’s market share.

- Your business’s share of unit sales

- Your business’s share of customers

- Your business’s share of sales in dollars

Which measure to use will depend on what product or service your business offers and what information you can find out about similar businesses in your area.

See How to Calculate Market Share for Your Business Marketing Plan and Calculate Your Small Business Market Share from dummies.com for more information on how to figure out your business’s market share.

Sales Breakdown

It is useful to break down sales by month for your first year of business so that your estimates are more accurate. This allows you to adjust your sales while you are building your business and customer base. It also allows you to show how sales might vary across different seasons or months. For instance, a small craft business that makes mittens out of old sweaters will have much higher sales in winter months and before Christmas than in the spring and summer months.

You can also break down sales by specific products or services to get estimates of each.

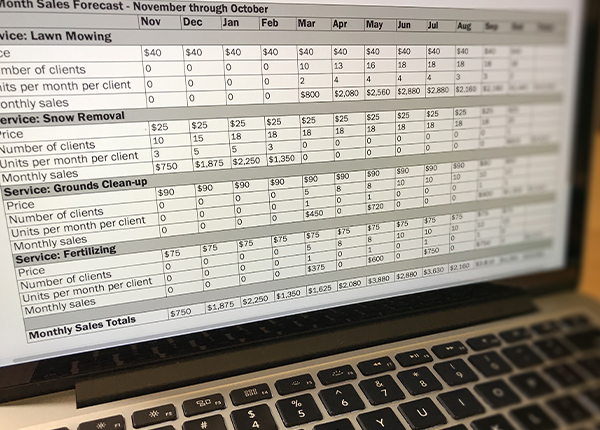

Example: Carl’s Lawn and Grounds Services

Carl is starting a lawn and grounds keeping business. He plans to offer lawn mowing, snow removal, raking/grounds clean-up, and fertilizing services. He researched other lawn and grounds keeping businesses in his area to come up with an average price for each of these services.

- Lawn mowing - $40 per job

- Snow removal - $25 per job

- Raking/ grounds clean-up - $90 per job

- Fertilizing - $75 per job

He expects that demand for his different services will change based on the season. He also expects that his number of customers will increase over time as his business begins to grow.

Snow Removal – 1st quarter

Carl plans to start his business in November. The only service he expects to provide during the first three months is snow removal. He has 10 steady customers lined up for November, but expects to have more customers in December and January. Based on discussions with other snow removal businesses in the area, he estimates 3 snow removal jobs per customer in November and 5 per customer in December and January.

Table 1 shows his sales forecast for snow removal services in November, December, and January.

| Row Labels | Nov | Dec | Jan |

|---|---|---|---|

| Price per snow removal | $25 | $25 | $25 |

| Number of customers | 10 | 15 | 18 |

| Units sold per month per customer | 3 | 5 | 5 |

| Monthly snow removal sales | $750 | $1,875 | $2,250 |

Notice that:

- Monthly sales = price × number of customers × units sold to each customer per month.

- The number of customers increases over time, reflecting business growth.

- The units sold vary across months to adjust for changes in expected snowfall.

Carl’s 12-month Sales Forecast

Carl completed sales estimates for all his services for each month of the year using a sales forecast spreadsheet.

First, Carl created a spreadsheet that included rows for each of the services he offers and columns for each month of business. For each service and month, he entered the price for each service, number of customers, expected units sold per customer, and monthly sales.

- Carl included estimates for each service he offered including lawn mowing, snow removal, grounds clean-up, and fertilizing. Some of these services overlapped across months, and some services weren’t offered in a specific month.

- The sales forecast included expected sales by month and for the year.

- Carl added the monthly sales totals to arrive at his total sales estimate of $29,580 for the year.

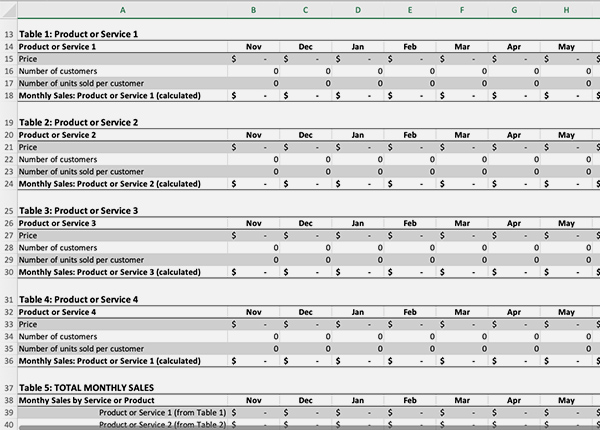

Sales Forecast Spreadsheet

We have included a sales forecast spreadsheet for you to use. The spreadsheet is provided in two different formats – one for Microsoft Excel and one for Google Sheets.

- If you don’t have Microsoft Office Excel software, you can access a free version of Google Sheets spreadsheet software from Google Drive.

- If you use a screen reader, we suggest downloading a free version of NVDA screen reader software, which does a better job navigating the tables.

- We have also included a sample spreadsheet for Carl, that you can use as a guide.

Sales Forecast Spreadsheets:

Getting Started

Once you have downloaded the sales forecast spreadsheet, you can begin to fill it in. For each of your products or services:

- Enter your sales price

- Estimate the number of customers you expect to have each month

- Estimate the number of units you expect to sell to each customer each month (this will often be 1)

-

The worksheet will automatically calculate your monthly sales using this equation:

- price × number of customers × units sold per month = monthly sales

If you are selling more than one product or service, the worksheet will calculate the monthly sales for each product or service you enter and show you the total monthly sales at the bottom.

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Cash Flow

Available cash is vital to business operations. Although your business may be profitable when sales are combined over several months, that doesn’t mean you made a profit every month. For instance, if you make most of your sales leading up to a specific holiday like the 4th of July, you may have higher rates of profit in some months (i.e. May, June, and July) and losses in other months. This is important to know because you need to cover your bills and other fixed costs when they are due each month.

Cash Flow Statement

The cash flow statement is a monthly record of your receipts (cash coming in) and disbursements (cash going out). It usually covers a one-year time period and shows when your business will receive cash (receipts) and when you need cash to pay bills (disbursements).

Each month you start with a cash reserve, or the money you have right now (also called cash-on-hand). During the month, your cash reserve increases by adding payments from customers. Your cash reserve decreases when you pay your fixed and variable operating costs. The money you have at the end of the month is your cash balance. This amount is also your cash reserve for the next month.

There are several parts of a cash flow statement:

Cash Reserve

The starting point for a cash flow statement is the cash reserve. It is important to have a large cash reserve when you first start your business. Not only will you use your cash reserve to cover start-up costs, but you will also use it to cover your fixed and variable costs until your business breaks-even.

If your cash reserve at the end of the month is below zero, this means you have used up your cash on hand, and your business will not be able to pay the current bills.

Receipts (Money In)

Receipts are money your business receives from sales or other sources such as gifts, grants, or short-term operating loans.

You might not always get paid right away when you sell a product or service. For example, businesses that invoice (or send bills) for sales and services usually get paid the following month. If this is the case, you need to account for it in your cash flow statement. It can get complicated to figure out across multiple months.

Here’s an example of receipts coming in across months.

Receipts Calculations – Green Grass Sprinkler

Table 1 uses the following information to calculate receipts for a sprinkler installation business for May, June, and July.

- Sales for the first three months are $5,000 for May, $6,000 for June, and $7,000 for July.

- Based on estimates from owners of similar businesses, 50% or half of the customers pay bills in the same month and 50% pay bills the following month. This means each month of sales will be received over two months.

| Row Labels | May receipts | June receipts | July receipts |

|---|---|---|---|

| May Sales = $5,000 | $2,500 | $2,500 | - |

| June Sales = $6,000 | - | $3,000 | $3,000 |

| July Sales = $7,000 | - | - | $3,500 |

| Total Receipts | $2,500 | $5,500 | $6,500 |

Disbursements (Money-Out)

Disbursements are made up of three types of costs:

- Variable operating costs, or the costs of goods sold, which are the materials and labor required to produce your product or service.

- Fixed operating costs, or costs paid each month whether or not you sell any product or service. They are things like rent, utilities, and insurance.

- Other expenses or costs related to loan repayments, capital expenditures, owners draw, and taxes, which are not variable or fixed operating costs.

The cash flow statement should show when you actually pay these costs. Some of these costs are paid every month, such as rent and utilities, and others may be only once or twice a year, such as insurance and license fees.

Ending Cash Balance

Your ending cash balance is the amount of money you have left at the end of the month. To figure out the ending cash balance, use this formula:

cash reserve + receipts – total disbursements = ending cash balance

Remember that the ending cash balance for one month becomes the starting cash reserve for the following month.

Having a positive ending cash balance does not mean that your business is profitable. For example, if your cash reserve is $300 in January, $250 in February, and $100 in March, you still have enough cash-on-hand to cover bills, but your cash reserve is decreasing over time.

Surplus or Deficit

To determine if your business is profitable for the month, use the following formula. If your answer is negative, it is a deficit and you are losing money. If your answer is positive, it is a surplus and you are making money.

receipts – total disbursements = surplus (+) or deficit (-)

- If you are operating at a surplus, this means that you are bringing in more money than you are spending each month—your receipts are more than your disbursements. You are making a profit.

- If your business is operating at a deficit, this means you are spending more money than you are bringing in—your disbursements are more than your receipts for that month. You are losing money.

- You can have a surplus in one month, but be operating at a loss for the year, if other months are operating at a deficit.

Ending Cash

Your ending cash for the month is the cash reserve for the month plus the surplus or deficit for the month.

Ending cash = cash reserve + surplus/deficit

If you have a surplus in the month, your ending cash will be greater than your cash reserve for that month. If you are operating at a deficit in the month, your ending cash will be less than your cash reserve for that month.

Your ending cash is the next month’s cash reserve.

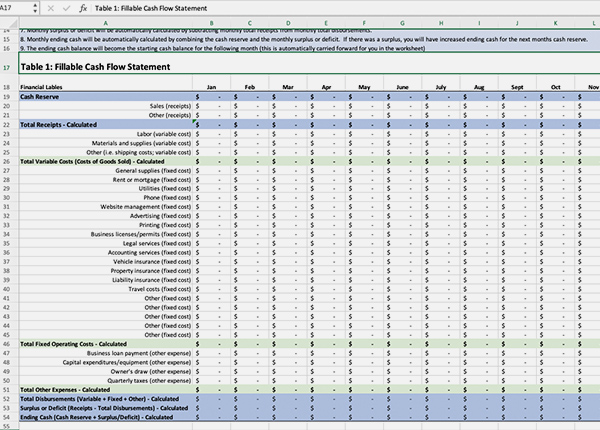

Cash Flow Spreadsheet

We have included a cash flow spreadsheet for you to use. The spreadsheet is provided in two different formats – one for Microsoft Excel and one for Google Sheets.

- If you don’t have Microsoft Office Excel software, you can access a free version of Google Sheets spreadsheet software from Google Drive.

- If you use a screen reader, we suggest downloading a free version of NVDA screen reader software, which does a better job navigating the tables.

- We have also included a sample spreadsheet for Gary’s Gutter, that you can use as a guide.

Cash Flow Spreadsheets:

Spreadsheet Tips

Here are some things to keep in mind as you put together your own cash flow statement:

- Ending cash is carried forward to the next month as cash reserve.

- Make sure to account for seasonal fluctuations and business growth in your sales and variable costs (costs of goods sold), because they impact your monthly receipts.

-

Receipts should be recorded when they are received and disbursements should be recorded when they are actually paid.

- If you invoice customers, sometimes receipts are delayed.

- Likewise, if you are invoiced for materials, you may not pay the invoice until a later date, like the following month.

-

All costs should be estimated as accurately as possible.

- Call utility providers to get installation prices, monthly fees, and projected expenses.

- Call suppliers for prices and credit procedures.

- Interview owners of similar businesses to estimate sales volume and collection delays.

- When in doubt, it is best to overestimate disbursements and underestimate income or receipts.

To get an idea of how to fill in a cash flow statement, follow along with the example below.

Example: Gary’s Gutter

Gary has a new rain gutter installation business. Download and print Gary’s Cash Flow – January to April to follow along with Gary’s cash flow estimates for January, February, and March.

Gary’s Gutter - January

Gary started his gutter installation business in January.

- His beginning cash reserve was $10,000.

-

His receipts for January were $0.

- Although his sales for the month were $5,000, he will not be paid for these jobs until February (50% of January sales, which equals $2,500) and March (50% of January sales, $2,500).

- His costs of goods sold (or variable operating costs) for January are $2,225.

- His fixed operating costs for January are $1,735.

- His other expenses for January are $4,909.

- Added together, his total disbursements for January equal $8,869. He found this number by adding together his costs of goods sold ($2,225), fixed operating costs ($1,735), and other expenses ($4,909).

-

Because Gary has no receipts in January, he is operating at a deficit of $8,869.

- $0 (receipts) - $8,869 (total disbursements) = - $8,869 (deficit, because his total payments are more than his receipts).

- If he subtracts this deficit from his starting cash ($10,000 - $8,869) that leaves $1,131 left in cash reserve to start the next month, February.

Gary’s Gutter – February

With the first month under his belt, Gary does these same calculations for February.

- His beginning cash reserve for February is $1,131 (this was his ending cash balance from January).

-

His receipts for February are $2,500.

- He receives $2,500 in February from jobs he completed in January.

- His February sales of $5,000 will not be paid until March (50% of February sales) and April (50% of February sales).

- His costs of goods sold (or variable operating costs) for February are $2,225.

- His fixed operating costs for December are $365.

- His other expenses for December are $659.

- Adding up his February costs of goods sold, fixed operating costs, and other expenses, his total disbursements are $3,249.

- To figure out if he is operating at a surplus or deficit, he takes his receipts and subtracts his total disbursements ($2,500 - $3,249 = -$749). He is operating at a deficit this month, because his total disbursements are more than his receipts.

-

Now, he plugs these numbers to determine his ending cash.

- $1,131 (cash reserve) + $2,500 (receipts) – $3,249 (total disbursements) = $382 (ending cash balance)

- From this, Gary determines he has $382 in cash reserve to start the next month, March.

Gary’s Gutter – March

Here is one more month.

- Gary’s beginning cash reserve for March is $382 (his ending cash balance for February).

-

His receipts for March are $5,000.

- He receives $2,500 in March from jobs he completed in January.

- He receives $2,500 in March from jobs he completed in February.

- His March sales of $5,000 will not be paid until April (50% of March sales) and May (50% of March sales).

- His costs of goods sold (or variable operating costs) for March are $2,225.

- His fixed operating costs for March are $365.

- His other expenses for March are $2,159 (this was higher than the last month because he had a quarterly tax payment due).

- Adding March costs, his total disbursements are $4,749.

- To figure out if he is operating at a surplus or deficit, he takes his receipts and subtracts his total disbursements ($5,000 - $4,749 = $251). He is operating at a surplus this month, because his total disbursements are less than his receipts.

-

Again, he plugs these numbers into the Ending Cash equation.

- $382 (cash reserve) + $5,000 (receipts) – $4,749 (total disbursements) = $633 (ending cash balance)

- Gary calculates he has $633 in cash reserve to start the next month, April.

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

The Income Statement

The income statement shows a business’s financial activity over a specific period of time, usually one year. It shows:

- Total sales

- Costs of goods sold

- Gross profit

- Fixed operating and other expenses

- Net profit

These estimates will be very similar to the yearly totals generated on the cash flow statement. However, the income statement is different from the cash flow statement because it is not estimated month-by-month. Instead, it shows your receipts and disbursements for the entire year. The income statement helps you figure out if your business made or lost money in that year.

Before your business opens, the income statement shows your best estimates of receipts and disbursements. Once your business is up and running, the income statement uses real numbers to determine your business profit or loss. Often, an accountant will help you develop your income statement and calculate your taxes based on the numbers.

View the Sample Income Statement for Gary’s Gutter to follow along with the following descriptions of the income statement parts. Notice the sample statement covers a specific time period measuring income from January 1, 2019 to December 31, 2019 (one year).

Parts of the Income Statement

The income statement includes several estimates including total sales, costs of goods sold, gross profit or loss, total fixed operating costs and other expenses, and net profit. These are described in more detail below.

Total Sales

Most financial planning begins with predicting sales over a specific period of time. To predict sales, you should do some market research, such as:

- Surveying similar businesses in other locations about their average sales

- Reviewing industry publications for average sales of similar sized businesses

- Searching Small Business Administration (SBA) publications

This information was covered in the Break-Even Analysis and Sales Forecast sections earlier in this chapter.

Total Sales for Gary’s Gutter was estimated at $68,125. He used the information from his cash flow statement to make this estimate (see Gary’s Gutter Cash Flow Spreadsheet - Excel).

Costs of Goods Sold

Variable operating costs or costs of goods sold are the direct costs to produce your product(s) or service(s). You can use figures from your cash flow statement to estimate your total costs of goods sold for the year. Here are some examples of costs of goods sold for retail, manufacturing, and service businesses.

- Retail business: the difference between the cost of the beginning and ending inventory, costs for shipping and packaging, and costs of labor directly related to sales.

- Manufacturing business: the costs of raw materials, parts, and labor to manufacture one item, multiplied by the number of units sold.

- Service business: expenses for providing the service, such as direct labor costs and any supplies. For instance, a lawn mowing business might include labor, gas, and lawn waste disposal costs.

The sample income statement for Gary’s Gutter shows total costs of goods sold as $35,580 which included labor and materials to complete Gary’s gutter installation jobs for the year.

Gross Profit or Loss

Gross profit is the difference between total sales and costs of goods sold. To figure out your gross profit, subtract the cost of goods sold from the total sales you made.

total sales – costs of goods sold = gross profit or loss

If sales are more than costs, there is a gross profit. If costs are more than sales, the business is operating at a loss.

Notice that the sample income statement for Gary’s Gutter reports $32,545 in gross profit. This was calculated by taking the total sales of $68,125 and subtracting the total costs of goods sold of $35,580.

Total Fixed Operating Costs and Other Expenses

Fixed operating costs are the costs of running a business that are not directly linked to the production of your product or service. These are things like rent, utilities, salaries, payroll taxes, advertising, insurance, office supplies, repairs and maintenance, and depreciation.

Other expenses are not part of operating the business or creating the good or service. These are things like interest payments on loans, capital equipment purchases, or owner’s draw.

You can use estimates from your cash flow statement to estimate your fixed operating costs and other expenses. For Gary, these were $7,764 for fixed operating costs and $19,733 for other expenses, which total $27,497.

Net Profit or Loss

If your business makes more money than it spends, you are operating at a net profit, which means your business is profitable. If your business spends more money than it makes, you are operating at a net loss, and your business is not profitable.

To figure out if your business is operating at a net profit or loss, subtract your total fixed operating costs and other expenses from your total gross profit.

Total gross profit – total fixed operating cost and other expenses = net profit (or loss)

Gary estimated his net profit as $5,048 for the year.

Future Income Statements

Once your business is up and running, your income statements will be based on actual receipts and disbursements, rather than estimates. These will help you evaluate how your business is performing over time.

It is good to work with an accountant to make sure you are doing all your business financials correctly and are paying appropriate local, state, and federal taxes.

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Balance Sheet

The balance sheet shows how much your business is worth at a specific point in time. It shows your total assets, total liabilities and the difference between the two, called equity. Equity is important for securing business loans because it serves as an incentive for you to pay back the loan. It is a bit like a down payment on a house.

Parts of the Balance Sheet

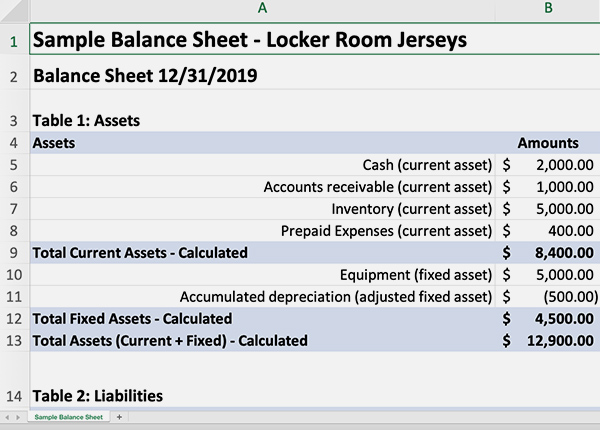

Download the Sample Balance Sheet for Locker Room Jerseys to see how the balance sheet is set up. To learn more, check out Balance Sheet Definition and Example from thebalance.com.

Total Assets

Total assets are all the things your business owns that have a cash value or could be sold for cash. Total assets are broken into two categories – current assets and fixed assets.

current assets + fixed assets = total assets

- Current assets include things that have a cash value such as savings, inventory, accounts receivable (payments owed to you), and prepaid expenses (like insurance – that would be refunded).

- Fixed assets include things that have a cash value but would need to be sold such as land, buildings, and equipment. When assessing the value of equipment or vehicles, you need to account for depreciation (or the reduction in value due to wear and tear or because it is becoming obsolete). To learn more, check out What is Depreciation? From profitbooks.net.

Locker Room Jerseys has $8,400 in current assets and $4,500 in fixed assets. Total assets for the business are $13,900.

Total Liabilities

Total liabilities are money your business owes to other businesses or companies. Total liabilities are divided into current liabilities and long-term liabilities.

current liabilities + long-term liabilities = total liabilities

- Current liabilities and the payments that are due immediately, such as what you owe to suppliers.

- Long-term liabilities are payments that need to be paid over time, such as long-term loans or a mortgage.

Locker Room Jerseys has $2,375 in current liabilities and $3,500 in long-term liabilities. Total liabilities for the business are $5,875.

Equity

Equity is the difference between a business’s total assets and total liabilities. Equity is how much your business is worth. You can figure out your business’s equity by subtracting your total liabilities (or how much you owe) from your total assets (or how much money you have).

total assets – total liabilities = equity

Locker Room Jerseys has $13,900 in total assets and $5,875 in total liabilities. That leaves $7,025 in equity.

Generally, a new business will develop a balance sheet every year in order to compare balance sheets over time to see if equity is growing, falling, or staying the same.

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Review

The Financial Plan is an overview of your anticipated receipts (cash coming in) and disbursements (cash going out). It shows your best prediction of how the business will grow over time and become profitable. It includes several sections:

- Up-front cash needs – cash needed to start-up the business and cover costs until the business starts earning a profit

- Break-even analysis – the amount of product or services that must be sold to cover variable and fixed operating costs

- Sales forecast – a prediction of sales over time

- Cash flow statement – a monthly accounting of receipts and disbursements to make sure you can cover your bills each month

- Income statement – a statement that shows your anticipated profit or loss for an entire year

- Balance sheet – a statement that shows the business’s worth or value at a given point in time.

Developing your financial plan is one of the harder parts of writing your business plan. But if you’ve made it this far, you have some good tools for getting started. There are also business development resources to help you develop a financial plan, which are included in the final chapter of this website, Chapter 8: Resources.

Prepare

First, take a deep breath—developing your financial plan can seem scary, but with some research and planning, you can do it!

- Use the Business Plan Outline to keep track of your progress.

- Refer to some of the business development resources listed in the Resources chapter to help you.

- Think about working with a bookkeeper or accountant to help you figure out your financials, or invest in bookkeeping software like Quickbooks.

Up-Front Cash Needs

Start developing your financial plan by figuring out your up-front cash needs. How much money will you need to start your business and keep it going until you make a profit?

Then, make a list of different sources of funds, such as personal savings, potential loans, or grants to cover these costs. To get most types of loans, you will probably need a full business plan, so keep working through all the sections in this chapter.

Break-Even Point and Beyond

Next, figure out your break-even point. How much will it cost to produce your product or service, and how much do you have to sell in order to cover these costs? Don’t forget to include both your variable and fixed operating costs in this calculation. Use the worksheets contained in the Break-Even tab to help you.

Also, consider pricing, and how different prices affect your break-even point. Figure out your gross profit for a few different price points and be sure to consider how much customers are willing to pay.

Finally, continue using the worksheets included in the various sections of this chapter to develop your best estimates of sales, cash flow, and income.

Keep Going

If you have made it this far through the website, you have probably put a lot of time and effort into your business idea. This is something that will serve you well if you decide to pursue self-employment. Planning is a very important part of business success!

But don’t get discouraged if you have had trouble working through this material. Business planning is complicated! That is why it is so important to use available resources to help you, such as Small Business Development Centers, business incubators, business mentors, and other people you know. Also, check out the final Resources chapter for additional ideas.

Circling Back to the Executive Summary

Remember, after you finish developing your business description, marketing plan, operations plan, and financial plan, you need to go back to the executive summary section (see Chapter 4: The Business Plan) to write an overview of your full business plan.

When it is finished, the business plan provides a guide for getting your business up and running. It is also a document to share with potential funders.

Most business owners use the business plan beyond the start-up phase to track progress and adjust their business operations. A thorough and complete business plan is worth the time and effort.

Click on the “VR Counselor Review” button for a short review of information for VR counselors from this chapter.

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Check Your Understanding

Checking the Financial Plan

To review your understanding of this chapter’s material, go through the following questions, and then a break-even scenario in Tab 2 and a cash-flow scenario in Tab 3.

Financial Plan Questions

Write down answers to the following questions. Then, check your answers in the REVIEW YOUR ANSWERS button.

Up-front Cash

What is up-front cash and what does it cover?

Break-Even Analysis

What does a break-even analysis help you figure out?

Sales Forecast

What are some things you should think about when you are putting together your sales forecast?

Cash Flow vs. Income Statement

How is the cash flow statement different than the income statement?

Tracking Cash Flow

Why is cash flow important to keep track of throughout the year?

Break-Even Analysis Scenario

Parker’s Tasty Dog Treats

Parker is starting a business making gourmet dog treats. He plans to sell them in local pet shops and directly to individual pet owners at craft fairs and online. He wants to know how many bags of treats he will need to sell in order to cover all of his expenses, and how many to sell to make a profit.

You will need the following information to answer the questions:

- The variable costs for producing one bag of dog treats are $5, which includes labor and materials.

- Fixed costs per month are $600, which include use of a commercial rental space, insurance, advertising, taxes, and an owner’s draw.

- Parker is planning to sell his dog treats for $10 per bag.

- Parker’s profit goal per month is $100.

Gross Profit

Using the following gross profit calculation, what is Parker’s gross profit per bag of dog treats?

price per unit – variable costs per unit = gross profit per unit

Break-Even Point

Using the following break-even point calculation, how many bags of dog treats does Parker need to sell to break-even?

fixed costs ÷ gross profit per unit = break-even point (number of units to sell each month)

Profit Sales Goals

Using the following profit sales goal calculation, how many additional bags of treats Parker needs to sell to reach his $100 profit goal?

profit goal ÷ gross profit per unit = profit sales goal (additional units to sell)

Total Sales

How many total bags of dog treats does Parker need to sell to break-even and reach his profit goal?

Click on PARKER’S BREAK-EVEN ANALYSIS to check your answers.

Cash Flow Statement Scenario

Parker’s Tasty Dog Treats

Parker developed a cash flow statement for the first six months of his business.

- Parker began his business in May with a $3,600 loan.

- He has to begin repaying this loan at a rate of $150/month after three months.

- Parker is going to sell his dog treats to pet stores for $10 per bag. As he starts out, Parker is asking for payment upon delivery – so there are no delays in receipts.

- He plans to take a $100 owner’s draw every month.

Download and print Parker’s Cash Flow Statement to answer the questions. Click on CASH FLOW ANSWERS to check your answers.

Receipts

Parker’s receipts are increasing over time. What does this show?

Surplus or Deficit

In what months does Parker earn a surplus (where total receipts are greater than total disbursements)

Cash Reserve

How much cash reserve will Parker have in November?

6-month Profit or Loss

What is Parker’s profit or loss during the first six months?