Vocational Rehabilitation Self-Employment Guide

Chapter 6:

The Operations Plan

Introduction

Within the business plan, the operations plan describes how your business will operate. In this section, you will explain where your business will be located, how you will make your product or provide your service, and how you will manage your business.

Parts of the Operations Plan

Business Location

The operations plan needs to include details about the location of your business. Will you rent space, or will you run your business out of your home? Do you own the building, or will you lease or make payments for the space?

Business Requirements

Every business has different legal requirements and approvals needed to operate. These include registering your business name, getting a federal taxpayer ID number, and getting required permits and licenses.

Costs

Every business needs money to start. In this section, you describe how much money you need to get your business ready to open and your estimated fixed and variable operating costs.

Production Methods

This section explains how you will make your product or provide your service, and how you will sell it. For example, what tools will you use, how much time is needed to make each product or service, and how will customers buy it?

Management

Running a successful business is more than making a good product or offering a service. You also need to handle tasks like bookkeeping, taxes, and cleaning your business. It is important to know how these tasks will be done and who will do them. You might do some yourself or get help from family, friends, or others.

We talk about each of these sections in more detail within the section tabs.

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Business Location

The business location section includes:

- Where your business will be located

- A description of the building or lot

- Whether you own or rent the space

How you describe each part of your business will depend on the type of business you have.

Business Location Parts

Physical Location

The description of your business location includes:

- The physical address

- A map of the area

- Any necessary approvals (like zoning rules or other restrictions)

- Benefits of the location

- Challenges of the location and how you plan to address them

It’s important to know how local regulations apply to your business location. These can vary by community. So, be sure to get the correct approvals from your city, county, and state departments.

Building and Lot

The building and lot specifications include:

- The building’s current floor plan, showing the square footage of each room

- A drawing of the entire lot, including parking spaces

- A description of how the lot will be used for storage, delivery, and other business activities

- A description of how each room in the building will be used

- A description of any other features of the building

- A drawing of any planned remodeling

You should also include the advantages and challenges of the building or lot and how you will address any issues.

Site Ownership or Lease Arrangements

The site ownership and lease arrangements section includes:

- Information about who owns the building and land

- If you have a lease, include:

- Monthly rent and utilities

- Length of lease term

- Who will pay for remodeling costs, property taxes, insurance, and maintenance costs (you or the landlord)

Site ownership and lease arrangements vary depending on your business location.

Example: Business Location

Jade wrote the following responses for Pizza Escape:

Physical Location:

- I have secured rental space at 111 18th, Polson, MT 59860. It is zoned for general commercial use with no other zoning requirements.

Building and Lot:

- The lot size is .16 acres, and the building is 864 square feet.

- The interior includes a large front room, with an accessible bathroom and storage area in the back. I plan to have a large counter near the front for single slice sales, with the kitchen taking up most of the main space. There is a front entry for customers and a side entry for drivers making pizza deliveries. The space has a side parking lot and two street parking spaces near the front that will hold up to 10 cars. I have included a diagram of the space and dimensions.

- The location is near lunchtime customers in the downtown area and about one-half mile from Polson High School.

Site Ownership or Lease Arrangements:

- The location is zoned as a business district.

- Rent is $1,200 per month, which covers utilities, remodeling, maintenance, property taxes, and insurance.

- The lease term is 5 years, with an option to end it after 12 months with no penalty, as long as I give 3 months notice.

- The landlord will handle renovating the space for the commercial kitchen. This will include additional electrical wiring for the pizza oven, plumbing for a commercial sink, and shelving over the worktable.

- I will be responsible for providing the front counter, stainless steel worktable, commercial sink, and pizza oven.

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Business Requirements

The business requirements section of the operations plan covers the legal requirements needed to open and run your business.

Business requirements vary based on business type, structure, and location. We highly recommend seeking advice from a lawyer, accountant, or local business mentor for this section, since requirements are unique for each business type. Many states have an economic development office that can help you understand what is needed to open your business.

You can search the U.S. Economic Development Administration’s Economic Development Directory to find local information for your state and area.

To get started, register your business name, and then think about requirements for taxes, licenses, permits, and insurance.

Registering Your Business Name

Even if it’s not required, registering your business name with the state is a good idea. Doing so helps people find and learn about your business. It also prevents other businesses from using the same name as your business. Contact your state’s Secretary of State Office to learn about the laws in your state and to register your business name.

For more information on why you should register your business name, visit the U.S. Small Business Administration’s Choose Your Business Name resource.

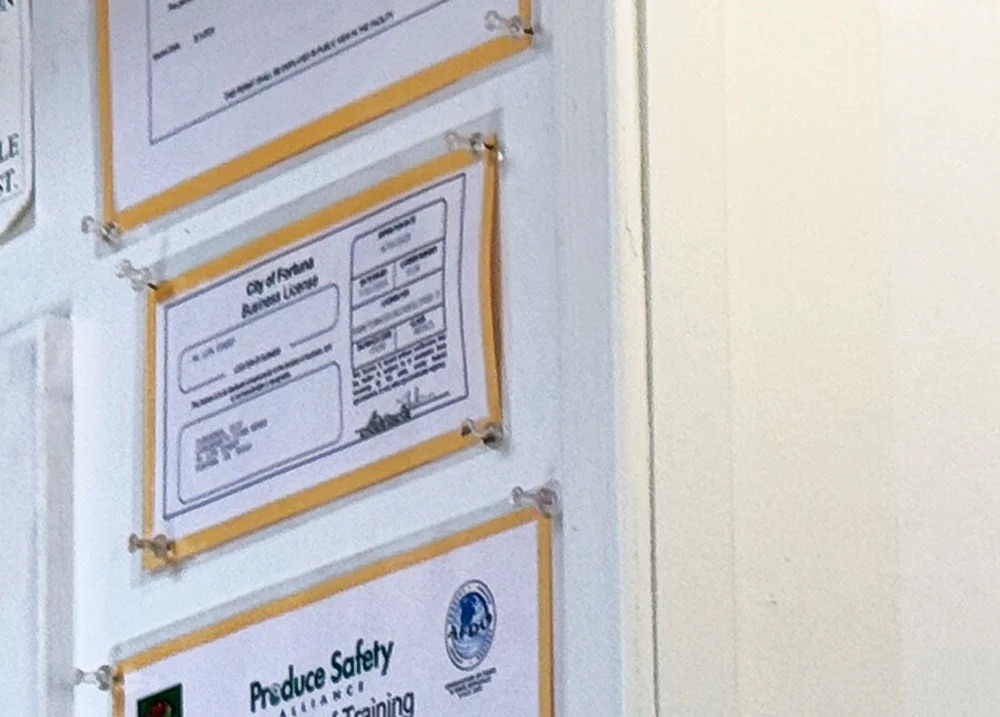

Business Licenses and Permits

Almost all businesses need some type of permit or license to operate. Finding out which ones you need can be tricky because requirements vary across states, counties, and towns. To learn what type of permits or licenses you need for your business, reach out to the Small Business Development Center in your state or a local business development agency. You can also search online, visit with a business mentor, or talk with local business owners to get an idea of what might be required.

The U.S. Small Business Administration website can help you identify what is required in your state. See their Apply for Licenses and Permits resource.

Different types of permits and licenses include:

- Professional licenses, required for some professions, such as a plumber or an electrician

- Business licenses to operate in a specific location, such as a local business license

- Permits to operate a specific type of business, such as a food services permit, a food handler’s permit, or a building health permit

Example: Business Licenses and Permits for Pizza Escape

Jade searched the Small Business Development Center website for Montana and found that no specific state-level business licenses are needed for her business. She also found no general business license requirements for Polson, where she plans to open her business.

She did an online search using the search terms “food service,” “Polson,” and “occupational license” and learned she needs to apply for a food service permit from the Lake County Environmental Health Department, since her business is located in Lake County.

Taxes

Federal Taxpayer Identification Number

A Federal Taxpayer Identification Number is a unique number used by the IRS to identify your business for tax purposes. You can usually use your Social Security number as your business tax ID. However, you might need an Employer Identification Number (EIN) if your business meets certain criteria or if you need to open a business bank account.

You need an EIN if you can answer yes to any of these questions:

- Do you have employees?

- Is your business a corporation or a partnership?

- Do you file a tax form for employment, excise, alcohol, tobacco, or firearms income?

- Do you have a Keogh plan (a tax-deferred retirement plan for people who are self-employed)?

- Are you involved with a trust, estate, real estate mortgage investment conduit, nonprofit organization, farmers’ cooperative, or plan administrator (someone who manages your retirement savings plan)?

Visit IRS: Employer ID Numbers to find more information about EINs and how to apply for one online.

State Sales Tax License

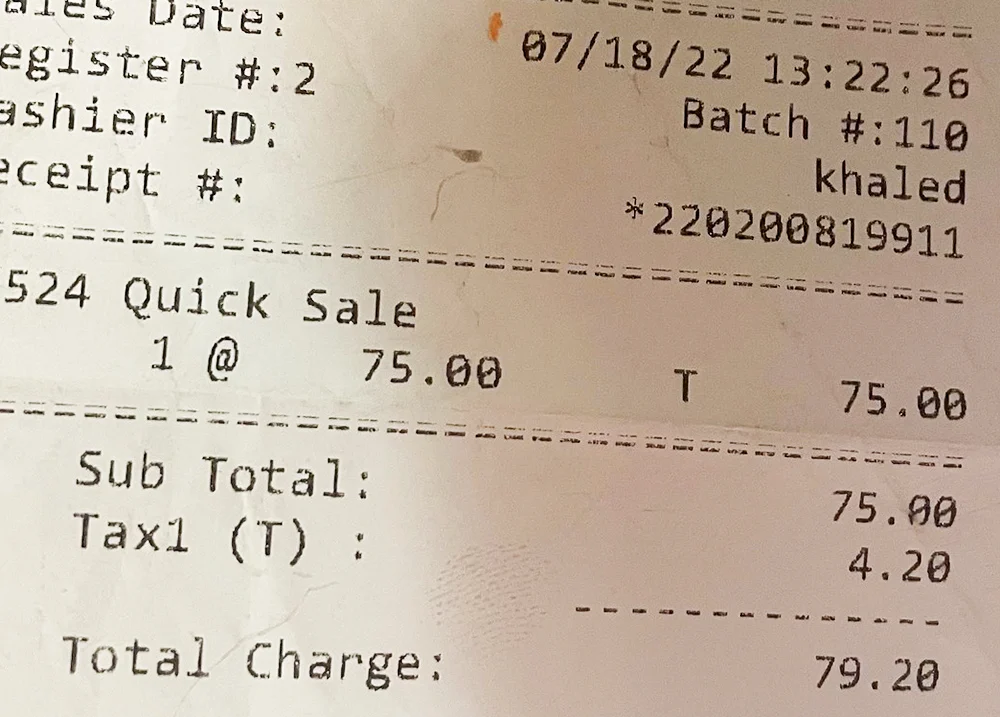

States with a sales tax require businesses to have a state sales tax license. If your state charges sales tax, you need to collect sales tax from customers. Not all states have sales tax, so check if your state does. For more information and a list of states with sales tax, see Wikipedia’s Sales Taxes in the United States.

For details on what sales taxes are, which products and services are taxed, and how to charge sales tax, see Sales Tax for Small Business on Debt.org.

Sales Taxes for Vendors and Online Businesses

Sales tax rules can be more complex if you sell at multiple locations or online. For example, if you have a booth at a craft fair, you may need to collect different sales taxes based on the fair’s location.

For sales tax information on craft fairs or other community events, see:

State-by-State Guide to Sales Tax at Craft Fairs and Festivals. Some states require a sales tax license, while others offer temporary licenses and permits.

Online businesses must also charge sales tax, usually based on the customer’s location, not the business’s. For example, if your business is in Georgia and a customer in Ohio buys from your website, you must charge Ohio sales tax on the product. Most e-commerce platforms automatically calculate the correct tax rate based on the customer’s address.

For more information, start here:

Local Taxes

In addition to federal and state business income tax, local jurisdictions and governments may also have their own business taxes, like local sales tax.

Your business structure (i.e., sole proprietorship, LLC, partnership), location, type of business, and your customer base (local or online) can affect your tax requirements. Please consult a professional to make sure you are doing things correctly!

Insurance

You should have insurance for your business, business property, and business vehicle. Depending on your business and location, you might need some or all of these types of insurance:

- Fire

- Theft

- Vandalism

- Vehicle

- Product or service liability

- Flood

Home-Based Businesses

If you run a business from home, you still need to get insurance for your business. Your homeowner’s policy does not usually cover your business. Also, your business equipment or products are not covered by your homeowner’s policy when they are stored in your house.

For example, an artist’s finished paintings are not covered for their value when stored at home. They are also not covered during transport to and from an art show, or while at the art show. You might need to obtain a rider (add-on insurance) to your homeowner’s policy, or purchase insurance through a specialty provider to cover your business. Please consult your insurance company for advice on the specific insurance coverage needed for your business.

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

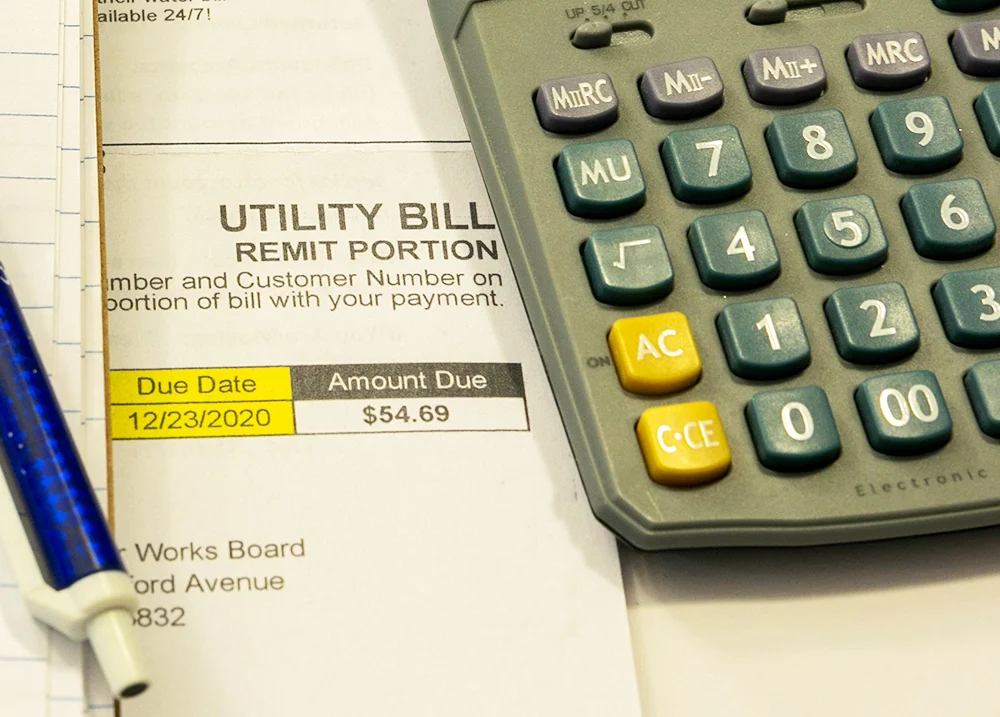

Costs

The costs section of the operations plan describes the main costs of running your business.

Costs are usually broken into three types:

- Capital expenses are one-time costs for larger items needed to run your business, such as equipment, furniture, or remodeling. You typically only need to purchase these items once, as they last a long time.

- Fixed operating costs are costs you always pay, even if you don’t sell anything. These are costs you pay every month or year, such as rent, utilities, insurance, and accounting services.

- Variable operating costs are costs for materials to make your product or provide your service. These costs are higher if you make a lot of your product, and smaller if you make less.

You already estimated these costs for your first month of business on the Start-up Costs Estimates Worksheet from “Chapter 3: Business Feasibility.”

Capital Expenses

Most capital expenses are for equipment, furniture, or fixtures. They don’t include land or buildings.

Examples include machines, special tools, office furniture, computers, displays, signage, and vehicles.

Justifications for Capital Expenses

List each of your capital expenses with the following information:

- The item with the make/model or reference number

- Why you need it

- Where you will get it, and why you chose that supplier

- Cost

- Terms and conditions (especially if the item has a payment schedule)

You already gathered most of this information back in Chapter 3 when you filled out the Start-up Costs Estimates Worksheet. Look back at the “Equipment,” “Furniture,” “Displays,” “Shelving,” “Remodeling,” and “Signs” sections.

Example: JT’s Tree Service

JT needs a laptop to manage his appointments, maintain his website, and run accounting software for his tree removal business. After searching prices and suppliers, he wrote this justification:

- Item: Dell Precision laptop

- Purpose: To run accounting software, schedule appointments, and maintain the business website.

- Supplier: Best Buy– chosen for good customer reviews, free delivery, and competitive pricing. They also have refurbished and pre-owned laptops at lower prices.

- Cost: $589.99

- Terms: Best Buy offers 12-month financing with low monthly payments and no interest if paid in full within 12 months.

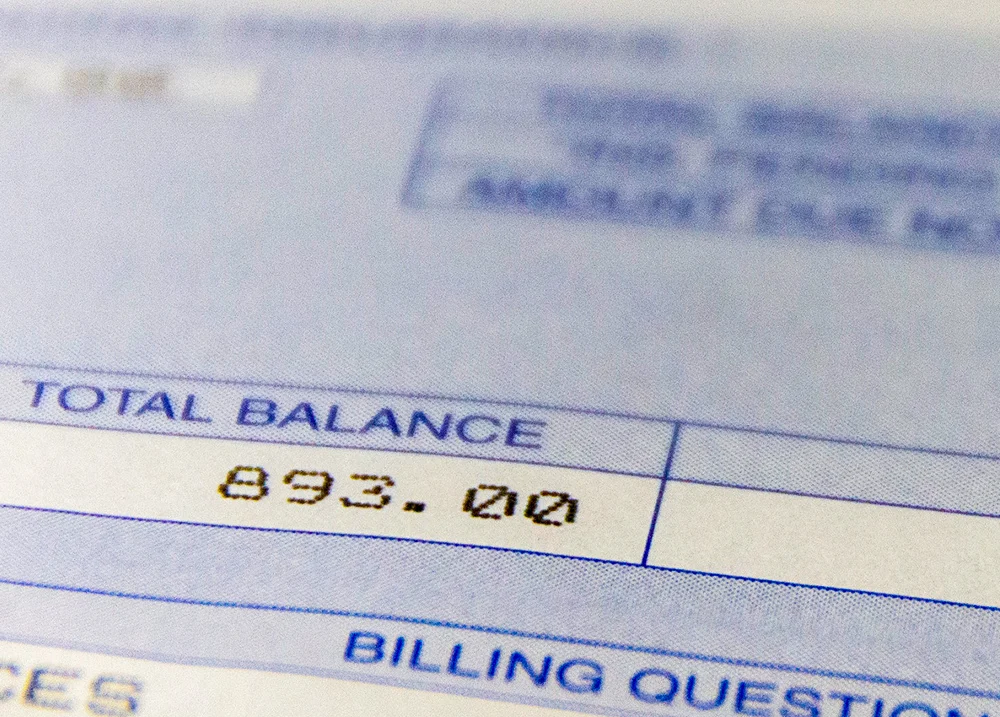

Fixed Operating Costs

Fixed operating costs are things you must pay for even if you don’t sell any product or service. They’re sometimes called overhead costs. Fixed operating costs include:

- General supplies

- Rent or mortgage payments

- Utilities

- Advertising

- Business licenses/registrations

- Legal and accounting fees

- Insurance

- Property taxes

Justifications for Fixed Costs

For each fixed cost, list the following:

- Item

- Supplier or who you are paying for this item

- Cost per item

- Units needed (if appropriate)

- Total cost

You already gathered much of this information back in Chapter 3 when you filled out the Start-up Costs Estimates Worksheet. Look back at the “Rent,” “Utilities,” “Advertising and Marketing,” “Business Licenses, Registrations, Permits,” “Legal and Accounting Fees,” and “Insurance” sections.

Example: Camila’s Salon Stop

Camila has several fixed costs for her salon business. Based on advice from another salon owner in town, she estimated her fixed utility costs for gas and electricity below. She’ll need to make similar estimates for her other fixed costs.

- Item: Gas and electricity

- Supplier or who you are paying: Mission Valley Power

- Cost per item: $60 per month on average

- Units needed (if appropriate): Not applicable

- Total cost: $720 per year

Variable Operating Costs

Variable operating costs change based on how much product you sell or service you deliver. These costs are usually estimated by month, quarter, or project to adjust for changes in sales.

Examples of variable operating costs include:

- Gas to travel to a worksite or deliver a product

- Mailing/shipping costs

- Credit card fees

- Materials to make your product

Justifications for Variable Costs

For each variable operating cost, list:

- The item and its purpose

- The main supplier and why you chose them

- Costs (per unit costs, units needed, and total costs per month)

- You can break down costs by months or quarters to adjust for changes, like production and sales increases or seasonal differences

- Terms and Conditions

- Payment terms and agreements with each supplier, including a written copy of any contracts

- Secondary supplier in case of issues like product shortage, delivery problem, or disagreement with the primary supplier

You have already gathered some of this information back in Chapter 3 when you filled out the Start-Up Costs Worksheet. Look back at the “Materials and Supplies” section.

Example: Flora’s Wedding Flowers

Flora is starting a florist business. Although her variable costs will vary depending on the size of each job and the flowers selected, she estimated costs for a typical medium-sized job.

- Item and purpose: Flowers for bouquets and table arrangements (100 daisies, 50 sunflowers, 3 bunches of baby’s breath, 3 bunches of wild ferns).

- Supplier: Pacific Flowers – local wholesale supplier with good prices and quality, and good customer service

- Cost: $150

- Secondary supplier: Benton’s Florist – local supplier with a similar range of products. Prices are slightly higher than Pacific Flowers, but the quality is good.

- Item and purpose: Ribbon (1 roll of white satin ribbon, 2 rolls of wide royal blue satin ribbon)

- Supplier: Michaels – local store with good selection and reasonable prices.

- Cost: $15

- Secondary supplier: Hobby Lobby – good selection and comparable prices to Michaels, but Hobby Lobby is in the next town, so I will have to drive further.

- Item and purpose: Containers (5 glass vases; 20 ceramic vases)

- Supplier: Michaels – fairly inexpensive and has a good selection.

- Cost: $100

- Secondary supplier: Hobby Lobby – good selection and comparable prices to Michaels, but they are in the next town so I will have to drive further.

- Item and purpose: Other (2 roles of green corsage tape; 20 foam bricks)

- Supplier: Pacific Flowers – floral design supplies at a good price.

- Cost: $30

- Secondary Supplier: Michaels – more expensive than Pacific Flowers, but they have everything in stock.

- Item and purpose: Travel (Gas to the wedding venue for set up and tear down. Estimated round trip of 100 miles)

- Supplier: NA

- Cost: $15

- Secondary Supplier: NA

- Item and purpose: Labor 10 hours of temporary help

- Supplier: Michelle Lee, my cousin, will work part-time for floral arrangement preparation. We have worked together before, and she has some floral design training.

- Cost: 1 person, 8 hours at $15/hr = $120 total

- Secondary Supplier: Judy Benson, my aunt, said she would be my assistant if my cousin can’t help out.

Section Review

Write down answers to the following questions, then open the “Review Your Answers” accordion below to compare your answers.

Shipping Costs Question

Is the cost of shipping a product to a customer a fixed or variable operating cost?

Rent Costs Question

Is rent for a workspace a fixed or variable operating cost?

Licenses Costs Question

Is the cost of renewing a license a fixed or variable operating cost?

Capital Expenditures Costs Question

Which of these costs are capital expenditures?

- Storage containers

- Computer

- Office desk

- Wood to build a product

Review Your Answers

Shipping Costs Answer

Question: Is the cost of shipping a product to a customer a fixed or variable operating cost?

Answer: Shipping costs are variable because they depend on having a customer place an order and on having a product to ship.

Rent Costs Answer

Question: Is rent for a workspace a fixed or variable operating cost?

Answer: Rent is a fixed cost because it needs to be paid regardless of the production of any product or service.

Licenses Costs Answer

Question: Is the cost of renewing a license a fixed or variable operating cost?

Answer: Renewing a license is a fixed cost because licenses need to be current as long as the business is operating.

Capital Expenditures Costs Answer

Question:

Which of these costs are capital expenditures?

- Storage containers

- Computer

- Office desk

- Wood to build a product

Answer:

- The computer and office desk are capital expenses because they typically last a long time. They can also be treated as assets for tax purposes.

- Storage containers are a fixed operating cost because they can be considered a general supply. General supplies are less expensive items that are not considered business assets, but are also not used up when you make your product.

- Wood for building a product is a variable operating cost, because it is used up when you make the product. The amount you buy also changes depending on how many products you need to make.

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Production and Management Methods

The production methods, management methods, and worker sections of the operations plan describe what you will do to make your product or provide your service, how you will sell it, and how to manage your business.

Production Methods

In the production methods section, you describe things like:

- Methods and Tools: How and when you will use your methods, tools, and equipment.

- Production Time: How long it takes to produce your product or service.

- Workspace: Where you will work and how much space you need.

- Storage: How you will store and protect valuable items.

- Labor: The amount and type of labor needed.

- Quality Control: How you will ensure the quality of your product or service.

- Regulations: How you will meet environmental and safety regulations.

- Inventory: How you will manage and track your inventory.

- Distribution: How you will distribute or sell your product or service.

Some of these will not apply to your business. For example, a gift shop buys products at wholesale and then sells them. In contrast, a pizza shop cooks a product to sell. So, a food safety regulation wouldn’t apply to a gift shop like it would to a pizza shop. Similarly, environmental and safety regulations do not apply to many types of businesses. However, they do apply to businesses that are using chemicals or materials that could be harmful to the environment and need to be monitored.

Sally’s Rocks & Talks – Production Methods Example

I will sell rocks and gems to locals and tourists visiting the area. I will buy products from two primary distributors (Minortown and Topgem) and visit two regional gem shows each year to look for unusual gems and rocks. In my store, I will display rocks in bins set on tables and gems in glass display cases. There will be reference books on a corner table that customers can use to look up information about different stones.

In the front of the store, I will have a computer that I can use to research specific rocks or gems for customers. I will also use the computer to make sales. In the back room, I’ll have a work computer and printer for day-to-day accounting and other business activities.

My computer has software that lets me track sales by product type. This will help me keep track of which rocks and gems I need to order. It will also show me which ones are selling the best. This information will help me keep track of customer preferences and sales, and it will help me see if I am meeting my pricing goals. My shop will have an alarm system, and I will lock up the valuable gems in a safe every night. At the end of each month, I will also take a manual inventory of my products so I can see if anything has been stolen or if my sales records have errors.

Management Methods

The management methods section describes how you will manage your business and handle business tasks that don’t include making your product or providing your service. It also covers who will help you with tasks if you’re not doing them yourself.

It includes descriptions of how you will do things like:

- Create an invoice

- Keep track of receipts and other paperwork

- Keep track of money coming in and money spent (bookkeeping)

- Pay the business’s bills, like rent and utilities

- Pay your business’s taxes

- Keep personal and business expenses separate

Sally’s Rocks & Talks – Management Methods Example

All of my sales will be paid in full. Customers can use a credit card, debit card, or cash. I won’t accept checks because many customers will be tourists, which could make it risky if a check bounces. I won’t carry accounts receivable, so I don’t need to worry about billing customers. I will use Intuit QuickBooks to track sales, inventory, business expenses, and accounts payable. I will take care of day-to-day bookkeeping and will be responsible for paying all bills. I will hire an accountant to help with business taxes and help establish a system for keeping personal and business expenses separate.

Workers

You may need different types of workers to help get your business up and running. For example, you might hire an accountant to help you with your taxes or temporary workers during your busy season.

Unpaid Workers

Unpaid workers are people who work for you for free. They could be family members or friends who help you do things to run your business. If you will be using any unpaid workers, you should describe:

- Who they are

- Their qualifications

- What they will do

- How their job will be covered if they can’t help

Professional Services

Professional service people provide an outside service to your business, like legal or accounting services. These people are not regular employees, but people you pay for a service. If you will be using any professional services, describe:

- Who they are

- The services they will provide

- Their qualifications

- How tasks will be managed if they can’t continue

Temporary Labor

Temporary workers are people you pay to help occasionally. For example, you might hire someone to help you put up fliers for your grand opening or package products during a holiday rush. If you will be using any temporary labor, describe:

- The services they will provide

- Their qualifications

- How you will hire them

Employees

Employees work for your business regularly on a part-time or full-time basis. If you will have employees, describe:

- What they will do

- Their qualifications

- How they will be compensated

- How you will hire them

Many businesses supported by VR will start with unpaid workers, professional services, and sometimes temporary labor. New businesses often don’t have regular employees at first. If you do hire employees, your business cannot be operated as a sole proprietorship.

If you plan to grow your business and hire part-time or full-time workers on a permanent basis, you should look at a business structure such as a limited liability corporation (LLC) that can support this (see “Type of Ownership” in Chapter 4).

Sally’s Rocks & Talks – Workers Example

My mom will help me clean my shop once a week. If she can’t help, then my sister will fill in. My dad will help me build display shelves for my store. He is a retired carpenter and will help me make sure my shelves are sturdy and safe. My family will work for free. Once the business is profitable, I’ll pay my dad as temporary labor when he helps with any small building projects.

I will hire Weaver Accounting to complete my taxes and to help me set up my QuickBooks accounting system.

If my business grows or I want to expand business hours, I will hire a part-time worker.

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Chapter Review

The operations plan outlines how you will make and deliver your product or service.

A good operations plan describes:

- Your business location and facilities

- Business licensing and insurance needs

- Your business operating costs and other related costs

- A description of your production process

- A description of your management methods and workers

Prepare

The operations plan is where you show your understanding of how to run your business. Use the information in this chapter to help you write the operations plan section in your Business Plan Outline.

Start by describing the location of your business and the necessary approvals.

- Physical location and ownership terms

- Licenses, permits, taxes, and insurance

Next, list out your costs, which include:

- Capital expenses

- Fixed operating costs

- Variable operating costs

Finally, outline your production and management methods.

- How will you produce your product or provide your service?

- How will you sell your product or service?

- How will you manage your business?

- What labor and services will you need?

- Will you have any workers?

Write down any questions you have or help you may need, and share these and your updated Business Plan Outline with your VR counselor.

VR Counselor Tips

Business Requirements

It is important for the counselor to make sure the consumer is aware of all the required business registrations, licenses, taxes, and approvals. These vary depending on the type of business, how it is structured, and where it is located. To determine business requirements, connect the consumer with a small business development professional or other local business mentor.

Production and Management

- Did the consumer cover the entire production process, from making and selling the product to ordering inventory, while also ensuring the production processes meet legal requirements?

- Did the consumer show awareness of the various business management activities required to run a business?

- Are there gaps in operations and management that could be improved with additional training or support?

- Would shadowing a business mentor help the consumer gain first-hand insight into day-to-day business operations?

Contract Workers

Many small businesses hire professionals, such as lawyers, accountants, or graphic designers, to help with business operations and advertising. Some of these services are crucial before finalizing the business plan, as they help the consumer understand the business structure and legal requirements.

Unpaid Workers

Many VR-supported businesses do not have paid employees. If they do have workers, they will often be unpaid family or friends who help with certain business tasks. The counselor should make sure the consumer has a backup plan if an unpaid worker can no longer help out.

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Check Your Understanding:

Assessing the Operations Plan

Read each of the three scenarios for Len, Tommy, and Jade. Each scenario covers different parts of the operations plan. Use this chapter’s information to answer the questions. Write down your answers and then compare them with the answers provided.

Scenario 1: Len

Len has listed out costs for his lawn care business. He already owns some equipment. Go through his list and figure out which costs are capital expenses, which are fixed operating costs, and which are variable operating costs. Explain your decisions and note if there are costs that might be missing.

- Truck repair

- Trailer

- Gas for traveling to customers’ properties

- Gas for lawn equipment

- Dump fees

- Lawn edger

- Hedge trimmer

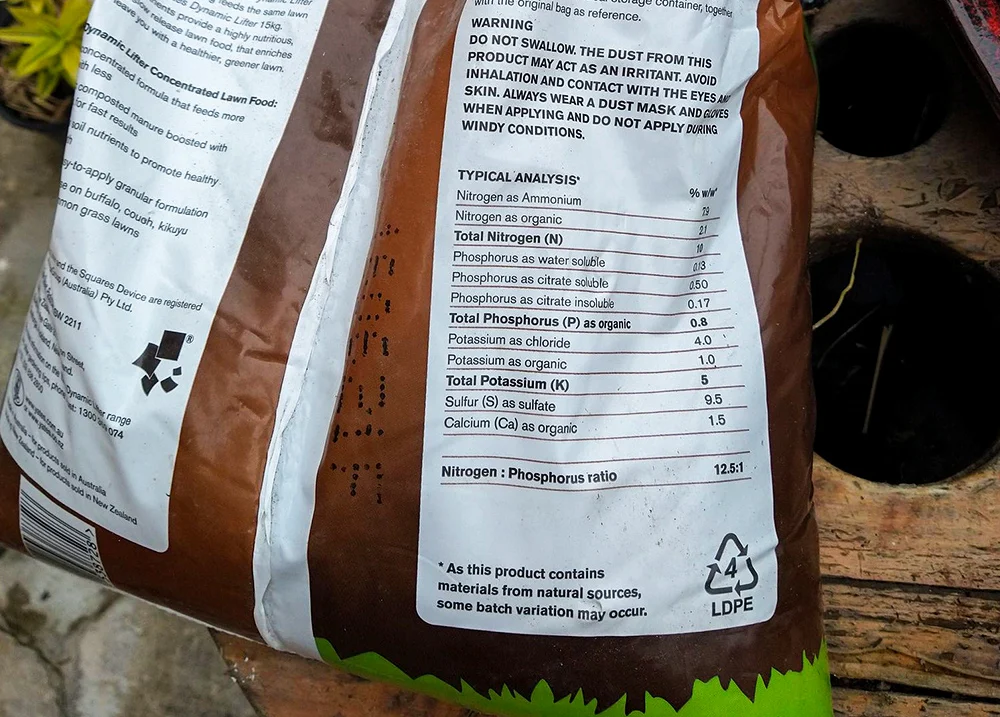

- Fertilizer

- Grass seed

- Aerator

- Advertising

- Computer for keeping books

- Accounting software (QuickBooks)

Open the “Len’s Lawn Care Costs” accordion below to compare your answers.

Len’s Lawn Care Costs

Len’s Capital Expenses

Capital expenses include truck repair, trailer, lawn edger, hedge trimmer, aerator, computer, and software. These are capital expenses because Len will only need to pay for these items when starting his business, and they should last for a year or more.

Len’s Fixed Costs

Advertising is a fixed cost because Len will have to pay for this regardless of how well his business does, and it is not directly tied to providing his service.

Len’s Variable or Operating Costs

Variable costs include gas, dump fees, fertilizer, and grass seed because they are used when he takes care of lawns. The amount he buys changes depending on how many customers he has and the jobs he completes.

Len’s Forgotten Costs

Len forgot at least two important costs: a business license and insurance. Both of these are fixed costs because a business license needs to be renewed each year, and insurance needs to be paid every month. They are not variable costs because they must be paid regardless of the number of jobs he completes.

Scenario 2: Tommy

Tommy is starting a business making wooden signs. He plans to sell them online, at craft fairs, and at community events. He lives in North Carolina and plans to travel around the state and occasionally out of state for his business.

What are some business registration, licensing, and insurance requirements that Tommy needs to consider before he can start his business?

Open the “Tommy’s Legal and Insurance Requirements” accordion below to compare your answers.

Tommy’s Legal and Insurance Requirements

Business Requirements

Some business requirements that Tommy needs to figure out include:

- If he needs a business license.

- Tommy is unsure how to get a business license, so he and his VR counselor search “North Carolina business license.” They explore the North Carolina Secretary of State website and find forms for applying for a North Carolina business license.

- How to register his business name with the state.

- Tommy searches online for “how to register a business in North Carolina.” He finds the North Carolina Secretary of State website, which has links to register his business and business name. He wants to do this so his business name is not confused with any other businesses in the area.

- If he needs a professional license.

- Tommy checked to see if there were any required professional licenses for his craft wood carving business. He learned that he does not need a professional license.

- If he is responsible for collecting sales tax for the state or other states.

- Tommy will be making his product out of his home in North Carolina. However, he will sell his work in multiple states. Tommy needs to figure out how selling in different states impacts the sales tax he must collect. He is planning to work with a business mentor who has sold art at craft fairs.

Insurance Requirements

Tommy also needs to figure out which insurance types he needs for his business. These could include general liability coverage, product or professional liability coverage, coverage for business property, vehicles, and workers’ compensation.

Tommy finds out he needs coverage for his materials, finished signs, and his vehicle. With his VR counselor’s help, he looks into adding on this coverage to his existing home and car insurance.

Scenario 3: Jade

Jade wrote the following production and management sections for her business plan to describe how she will make and sell pizzas and manage her business. Read through her plan and think about what might be missing or how you could improve her descriptions.

Pizza Escape: Production Description

I will sell pizza to locals and tourists visiting the area. I plan to purchase crusts from Tynell’s Breads, a local bakery. Tynell’s Breads has good name recognition in the area and offers a medium-priced and good-tasting product. I will purchase meat and vegetables from the local farmers’ co-op when I can. When that is not an option, I will use the local grocery store because they have a quality butcher shop and produce section. I have partnered with Dave’s Dairy nearby to supply cheese. I will make my own sauce, a family recipe that I have used for several years.

I have looked into various types of pizza ovens and have been able to locate a used fire pizza oven that I can purchase at a good price. The commercial kitchen that I am sharing with another business already has a freezer with plenty of space to store fresh food.

Pizza Escape: Management Description

In the front of the store, I will have a tablet with Square payment software and a cash drawer so I can accept various types of digital payments (like Apple Pay), credit and debit cards, and cash. I will not accept personal checks because they could bounce.

I will be responsible for most tasks, including stocking supplies, baking pizzas, and serving customers. My younger brother can work for me during the busy summer months, and my friend has agreed to help as needed. The other business I’m sharing space with already pays for a cleaning service, so we have agreed to split the costs.

Open the “Jade’s Production and Management” accordion below to compare your answers.

Jade’s Production and Management

Additions to the Production Description

Jade did a good job of describing how she would make pizzas, but didn’t explain her service or how she would sell them. Is it dine-in, take-out, or delivery? Is she selling full pizzas, slices, or both? What kind of variety will she offer? Will she sell anything besides pizza, like drinks?

Additions to Management Description

Jade described her payment system and the different types of workers she will have and their tasks. However, she didn’t explain how she will pay her bills, keep track of business expenses, or track sales and inventory. She also did not describe how she will do her taxes and accounting. Will she do her own taxes and keep her own books, or will she hire professionals?

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.