Vocational Rehabilitation Self-Employment Guide

Chapter 4:

The Business Plan

Introduction

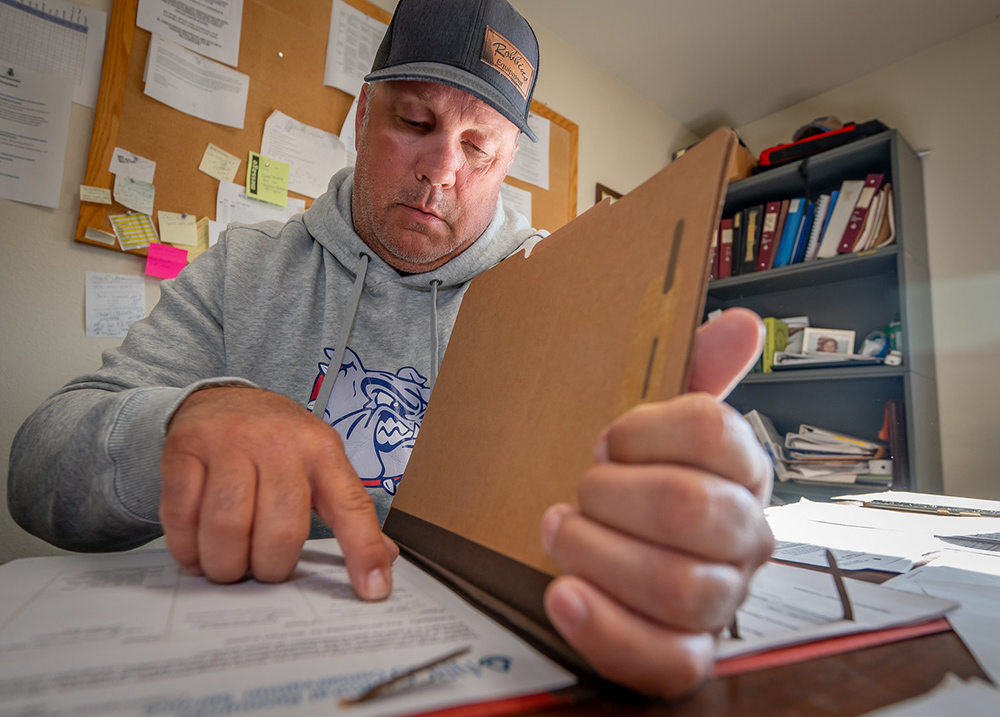

This chapter introduces the Business Plan. The business plan is a road map for getting your business started. It is where you write down the details about what you need to do to get your business up and running. The business plan expands on the information you filled out in the worksheets for “Chapter 3: Business Feasibility.”

Planning is an important part of any successful business. Working on your business plan helps you think through strategies and make decisions before you open your business.

Your VR counselor will use your business plan to:

- Help you set goals

- Learn what help you need

- Evaluate your progress

- Identify start-up costs and financial needs

If you are trying to get a loan to cover start-up costs, a bank or lender will use your business plan to decide whether they will support your business.

Remember, self-employment is not a vocational goal itself, but a way to meet a vocational goal. Writing a business plan will help you figure out how to turn your vocational skills into a business.

Download and follow along with an Example Business Plan for Rainbow Siding to see examples of different parts of the business plan.

Parts of the Business Plan

Structure

Most business plans include five sections:

- Executive Summary

- Business Description

- Marketing Plan

- Operations Plan

- Financial Plan

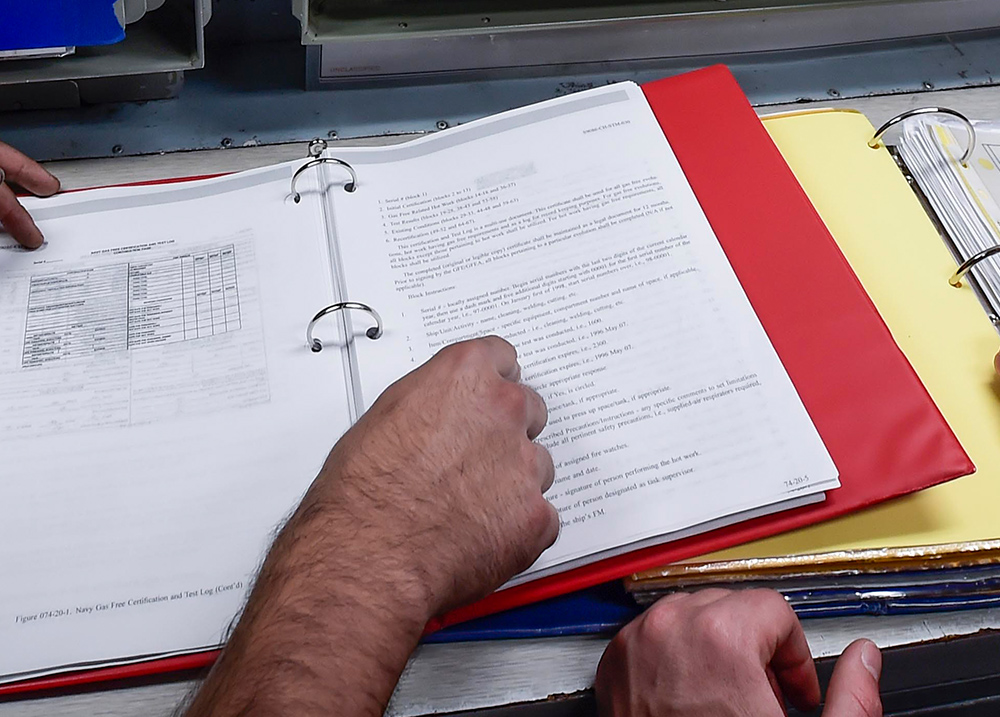

Business Plan Outline

Every business plan is different, but most follow a similar outline. To follow the outline used in this guide, please download and save the Business Plan Outline. You can use this outline to develop your own business plan.

In this chapter, the Executive Summary and Business Description sections are covered in detail. The other sections of the business plan are covered in later chapters.

Executive Summary

The Executive Summary is a short overview of your business plan that explains:

- Your business idea

- Your customers

- Day-to-day operations

- Finances

It helps people decide if they want to read your detailed business plan.

Business Description

The Business Description includes:

- A short description of your business

- How you came up with your business idea, and why your business is needed

- The type of business ownership you will use for your business (your business structure)

- Information about similar businesses or your competition

- Your strengths and experiences that will help you be a successful business owner

Marketing Plan – Chapter 5

The Marketing Plan includes information about:

- Your future customers

- Why customers will want to use or visit your business

- How your proposed business will stand out from similar businesses

- How you will tell customers about your business (advertising and promotion)

Operations Plan – Chapter 6

The Operations Plan is where you explain how you will run your business. It includes information about:

- Your business location or building

- Legal requirements, including licensing, taxpayer registration, and insurance

- Necessary materials and supplies

- Costs of running your business

- What you will do to make your product or provide your service

- How you will manage your business (such as bookkeeping, tracking inventory, or filing taxes), and who will help you do these things

Financial Plan – Chapter 7

The Financial Plan is where you estimate how much money you will spend and how much money you will make in your new business. It shows that you have enough money to start and run your business. It shows that you have considered how you will manage your business finances. It includes information about:

- What you need to pay for, and where you will get the money to start your business

- How much you should charge for your goods or services, and how much you must sell to cover all of your business costs

- How much you will spend and how much money your business will make each month to keep your business running

- How much your business is worth

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Executive Summary

You use the Executive Summary section to briefly describe the main idea and value of your business. This is the first thing people will read about your business. The executive summary should be short and easy to understand. It should show how you will be a good business owner.

Often, banks or other lenders use the executive summary to decide if they will read your full business plan and offer you a loan.

Executive Summary Parts

Although the Executive Summary is listed first, it is the last section you will write because it summarizes the other sections of the business plan.

The executive summary should include:

- A short description of what the business will do.

- A short description of your skills and experiences that show how you are qualified to run your business.

- A short description of your customers and how you will tell them about your business.

- An overview of your financial information, including:

- How much money you will need to start-up and run your business (which includes your start-up and operating costs).

- How much money you plan to borrow.

- How much money you think your business will make in the first and second years of your business operations.

Clear and Brief

When writing the executive summary, don’t use words that some people may not know. You want everyone to understand your business idea without needing additional information.

It is a good idea to have a family member or friend who doesn’t know about your business read through your executive summary. Ask them for feedback:

- Ask if they understand what your business is about.

- Ask if they are confused.

- If they are confused, ask if they (or someone else) can help you find different ways to explain your business summary.

The executive summary should be short. A good length is 1 or 2 pages that highlight the main sections of your business plan.

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Business Description

The Business Description section is made up of five different parts:

- Company Description

- Business Background

- Owner Qualifications

- Type of Ownership

- Business Industry Description

We cover the Company Description, Business Background, and Owner Qualifications sections below.

The Type of Ownership and Business Industry Description sections are covered in their own section tabs.

Company Description

The Company Description is a 1- to 3-sentence statement about your business. It includes:

- Your business name

- A short description of the products or services your business will provide

- A short description of who your customers will be

Here are some examples:

- First Light Café will feature homestyle breakfasts and lunches in a cozy atmosphere. Hearty and affordable meals will appeal to a wide range of customers, including families, workers on their lunch break, and local residents.

- Wolverine Towing will provide towing and roadside emergency services to travelers in Billings and surrounding areas.

- Pizza Escape will provide specialty and made-to-order pizzas for pick-up and delivery for residents looking for a quick and delicious meal at home.

Business Background

The Business Background section describes how you developed your business idea, why the business is needed, and what you have done to prepare to open your business.

To get started, answer these questions about why your business is needed. (You may have already answered some of these questions in the About You and About Your Business worksheets described in the last chapter. You can review your previous answers to help you.)

Business Need

Why is your business needed?

- What led to your business idea?

- How is your business different from other businesses offering the same or similar products or services?

- What gap or need does your business fill?

Example – Pizza Escape Business Need

I plan to start a pizza delivery business in my small town of 5,000 people. When I lived in a bigger city, I loved having pizza delivered to my apartment. When I came back home to be closer to my family, I realized that no businesses in town offered pizza delivery. Pizza Escape will offer quality pizzas for delivery to fill this gap.

Activities to Date

What have you accomplished for your business?

- How has your product or service been tested or reviewed?

- What skills and resources do you have to make this business successful? This includes things like:

- Your previous experience and expertise

- Strong advisors or a business mentor

- A good business location

- What accommodations for your disability have been arranged?

Example – Pizza Escape Activities to Date

I have looked into suppliers for my pizza ingredients. A local bakery has agreed to make pizza dough, and I found a regional supplier for quality cheese and meats. I have made and tested several pizza sauce recipes and settled on one that got great reviews from family and friends.

I have located an accessible commercial kitchen space to share with a local bakery. The owner is interested in sharing the space to reduce costs, and we think it will work out well because our business hours do not overlap during our busiest times. The bakery will keep the storefront, and I can lease space and operate my business from the back of the building for deliveries.

Owner Qualifications

The Owner Qualifications section provides information about you, the business owner. This is where you share information about strengths and experiences that will help you be a successful business owner. This includes information about things like:

- Your skills, knowledge, and training

- Your experience working in similar businesses

- Your management experience

- Your marketing or advertising experience

- Other resources you will use to help you run your business, like business advisors, or someone who can help you with bookkeeping

- Accommodations or backup plans you have in place to keep the business running when health or disability issues arise

Use the information from the About You Worksheet you completed in “Chapter 3: Business Feasibility” to help complete this section.

Example – Pizza Escape Owner Qualifications

I have work experience in the food industry, both in the kitchen and the front-of-house service areas. I understand the details of working in a restaurant. I also used to deliver papers when I was younger, so I have some experience with door-to-door delivery. I have never made pizzas in a commercial setting, but have made them at home for myself, friends, and family for a long time.

My sister is a bookkeeper, and she has agreed to give me pointers for managing my business accounts. She said she will review my accounts for the first couple of months to make sure I am doing things correctly. I also have a friend who works at the local credit union, and he can help me figure out how to apply for loans.

During my business start-up phase, my family is willing to fill in for me if I have a pain flare-up related to my disability. Once the business is up and running, I plan to hire and train a manager-level employee so they can take over the day-to-day operations when I am not feeling well.

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Type of Ownership

The Type of Ownership section is where you explain the type of business ownership you will use. The type of ownership you choose for your business will affect how much you pay in taxes, what paperwork you need to file, and your personal liability (which means your legal responsibility if someone sues your business).

There are different types of business ownership structures you can choose from for your business. In this section, we cover three of the most common options for small independently owned businesses, including:

- Sole Proprietorship

- Partnership

- Limited Liability Company

Each form of ownership has advantages and disadvantages, depending on your specific business and financial situation. Figuring out the business ownership structure that’s best for you can be confusing. We recommend working with an expert, such as an advisor from a Small Business Development Center, to help you make a good decision.

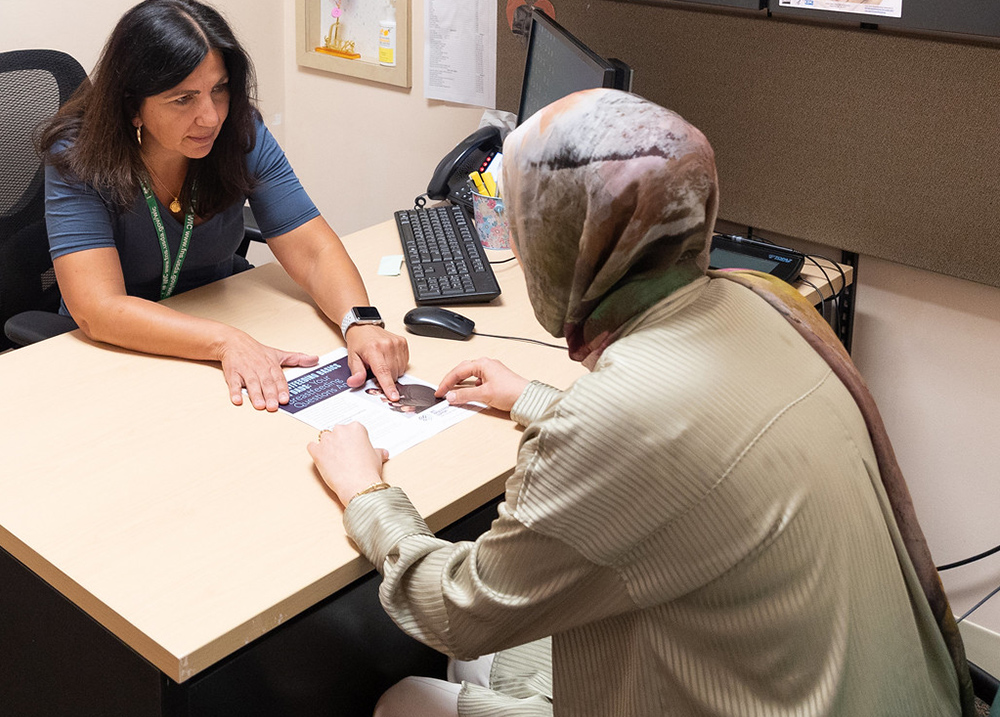

Warning: If you receive SSI or SSDI payments, you should also work with a Work Incentives Planning and Assistance (WIPA) expert or Community Work Incentives Coordinator (CWIC), who can provide accurate information about how work will impact your benefits. To find a WIPA or CWIC, you can go online to the Ticket to Work Find Help Tool. Select “Benefits Counseling (WIPA)” in the Provider Type section. Or call the Ticket to Work helpline at 1-866-968-7842 or 1-866-833-2967 (TTY).

Ownership Types

The following information about business ownership types was adapted from the Small Business Administration website. Visit Choose Your Business Structure to learn more.

Sole Proprietorship

A sole proprietorship is a common business type for businesses owned by one person. However, with a sole proprietorship, there is no legal separation between you and your business. This means that you are personally liable or responsible if something happens to your business. If your business goes into debt or gets sued, you might have to use personal assets (such as your savings, car, or house) to pay back or settle any debt.

Sole Proprietorship Pros:

- Easy and typically inexpensive to set up

- Owner has complete control of the business

- Easy tax preparation

Sole Proprietorship Cons:

- The owner is personally liable for business debts or any legal issues that might come up.

- Because of this, it can be harder to get a loan, because the bank or lender might be worried that if something happens to your business, you won’t be able to pay back the loan.

- Taxes can be higher than with other types of business structures.

Partnerships

A partnership is a business type owned by two or more people. Partners share responsibilities for the business. They also share personal liability for the business, which means that if the business is sued or goes into debt, any legal action taken against the business affects all the partners.

It is important to have a written record or legal document that describes the partnership agreement. The document should describe each partner’s responsibilities and tasks, so it is clear who is doing what. Not all partnerships split debts and profits evenly, so it is also important to describe how these will be split between partners.

Partnership Pros:

- Partnerships are typically easy and inexpensive to set up.

- Partners share the costs of starting and running the business.

- If you have employees, you could offer them the option to become a partner as your business gets bigger.

Partnership Cons:

- All partners are personally liable for business debts or any legal issues that might come up

- Partners might argue over things, which could hold up important business decisions. Also, if one person leaves the partnership, it can be hard to replace them.

- Profits are shared between all partners, even when each partner may do different amounts of work. This can be addressed, however, with a written partnership agreement that describes each partner’s responsibilities and share of business debts and profits.

Limited Liability Company (LLC)

A Limited Liability Company (LLC) is a business type owned by one or more people. Owners are called ‘members’ instead of owners. Unlike a sole proprietorship, with an LLC, your business and personal assets are separate. This means that if something happens to your business, you are not personally liable or responsible. For example, if you can’t pay back your business loan, the bank can’t take your house or car to get its money back.

LLC Pros:

- Members are not personally liable if the business gets sued.

- It may be easier to get a business loan because an LLC is more formal than a sole proprietorship.

LLC Cons:

- LLCs are more difficult to form than a sole proprietorship or partnership, and you have to pay a fee every year to the state to stay registered.

- You might have to pay self-employment taxes (which can be higher than other employment taxes).

Other Business Types

Other business types include C-Corporations and S-Corporations. These are more complicated business structures that are generally used by much larger businesses. These are covered on the Small Business Administration‘s Choose Your Business Structure webpage.

Business Structure Considerations

Most VR-supported businesses are owned and operated by one person. For this reason, sole proprietorships or Limited Liability Companies (LLCs) are common ownership types.

If you receive SSI or SSDI, you need to know how different business structures will count towards your assets, or the resources you have (like your savings, car, or home). Some of your resources don’t count towards SSI or SSDI resource limits, but it’s important to know which do and don’t. Talk to a Work Incentives Planning and Assistance (WIPA) expert or Community Work Incentives Coordinator (CWIC), who can provide accurate information about how work will impact your benefits. Then, talk with your VR counselor about which ownership type is best for you.

Resources

Other Business Types

For more information about business structures, visit Types of Business Structures Explained.

For more information about forming a Limited Liability Company, visit What is an LLC?.

Business Structures and Public Benefits

For an overview of different business structures and how they can affect public benefits like SSI and Medicaid, visit Self-Employment Q&A: Selecting a Business Structure.

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Business Industry Description

The Business Industry Description section is where you share information about your business’s industry. This section shows that you have done background research to more fully understand the business you are planning to start.

An industry is a group of businesses that produce similar products or services. For instance, the pizza industry is made up of many different types of businesses that make and sell pizza. These businesses include sit-down restaurants, carryout-only pizza shops, companies that make frozen pizzas, and food trucks.

You can find out all kinds of information by learning more about similar businesses, such as:

- How they price their product or service.

- How many customers they serve.

- Busier and slower times over the year.

- Advertising strategies.

- Barriers that might make it hard to set up your business, like high start-up costs or government regulations.

Industry Research

In order to write the business industry section, you need to learn more about businesses similar to yours. Learning about your business’s industry can help you figure out how best to run your own business. It also helps you develop a realistic idea of how much your business might sell, charge, and make over time.

This section includes questions that you can use as a guide for doing your own industry research. It also provides some ideas of strategies and resources you can use to start your industry research. Questions were adapted from the article First Steps: Writing the Industry Section of Your Business Plan.

Industry Description

Describe the industry:

What are the different types of products or services offered by other businesses in your industry?

Example: Pizza Industry Description

In the pizza industry, businesses offer pizza for sit-down dining, take-out and frozen pizzas to bake at home, and pizza for pick-up and delivery. Also, many pizza businesses offer sides and other options, such as salads, breadsticks, wings, and drinks.

Industry Sales

Describe sales in this industry:

- How much money did similar businesses make in similarly sized locations?

- Is the industry growing or changing?

- Do sales change throughout the year?

- How does the economy impact your industry?

Example: Pizza Industry Sales

Last year, the pizza industry had 41 billion dollars in sales and made up 18% of all restaurants in the U.S. Based on trend data, pizza sales are growing by about 1% per year. According to one industry report, 50% of pizza businesses are small and independently owned. One research firm reported that 93% of people eat pizza on a monthly basis. Overall, pizza sales are steady across the year but are growing over time. Sales are even across different regions or locations.

Similar Businesses

Describe similar businesses:

- What are similar businesses like?

- What are their strengths?

- What are their challenges?

- Who are their customers?

Example: Pizza Industry Businesses

Overall, small independently owned pizza businesses had a 2% drop in sales, while franchises such as Little Caesars and Pizza Hut had a small increase. Industry reports say that sales are higher for businesses that offer online ordering. Important customers for independently owned pizza businesses include people in their 20s and 30s who value high-quality food, are loyal to brands, and support local businesses.

Marketing

Describe the marketing of similar businesses:

How do similar businesses market or advertise their services or products?

Example: Pizza Industry Marketing

Pizza franchises generally use national marketing strategies that focus on television ads. They also mail out postcards that advertise deals or specials. Smaller, independently owned pizza shops market their businesses on the internet and social media. They have websites where customers can order online, special coupons and deals on social media, and send “hot deal” texts to customers. They also advertise using flyers, local newspapers, and the radio.

Challenges to Entry

Describe the challenges to entering this industry:

Are there challenges that make it hard to start businesses in this industry, such as government regulations or high start-up costs?

Example: Pizza Industry Challenges to Entry

Any business that sells prepared food must meet food service regulations. This includes requirements for commercial kitchens and health inspections. Start-up costs can be large, depending on the size of the business. For instance, small commercial pizza ovens can run in the $5,000 to $10,000 range, while large-capacity pizza ovens can cost $10,000 to $30,000.

It is easier for larger, established businesses to attract customers based on price because they can order supplies in bulk and charge less. This can make it harder for smaller, independently owned businesses to gain customers.

Trends

How is this industry changing:

- Do any technological trends affect the industry?

- How are changing customer preferences affecting the industry?

- How are demographic changes affecting the industry, such as a growing aging population?

Example: Pizza Industry Trends

According to the 2018 Pizza Power Report, pizza businesses that had websites, social media accounts (such as Facebook), and offered online ordering and delivery had higher rates of growth. The report also said that the number of independently owned businesses was shrinking. In general, customers are requesting more gluten-free and locally sourced options. A Gallup Poll reported that people 65 and older had the highest preference for take-out pizza.

Financials

Describe the industry’s financial outlook:

- What are key financial measures in the industry? These are things like:

- Average profit margins

- Average sales

Example: Pizza Industry Financials

Profit margins vary across the pizza industry. Industry averages range from a 7% to 20% profit margin based on the type of business. With a 7% profit margin, a business only makes 70 cents on each $10 pizza sold, whereas a 20% margin would generate $2 for each $10 pizza sold. Generally, smaller pizza establishments reported higher profit margins but lower overall sales and sold approximately 75 to 100 pizzas per day.small commercial pizza ovens can run in the $5,000 to $10,000 range, while large-capacity pizza ovens can cost $10,000 to $30,000.

Information Sources

When starting a business, it’s important to understand the trends that may affect the business’s overall success. To do so, you must investigate different information sources, as well as learn more about similar businesses. Thankfully, there are a lot of ways for you to gather information about similar businesses.

Small Business Development Center

You can find free market research reports through the Small Business Development Center (SBDC) network. These reports include industry trends, market statistics, customer demographics, recent business articles, and links to industry trade associations.

- The U.S. Small Business Administration’s Market Research and Competitive Analysis webpage provides a list of free, reliable sources for customer and market information.

- If you are working with an SBDC advisor, they can help you pull industry reports for free.

People

To gain a better understanding of how to get your new business started, it’s important you talk to other people, such as:

- Potential customers

- Ask them where they shop for products or services like the ones your business will offer.

- Ask them why they use the businesses they use.

- Business owners from a similar industry in another community

- Ask how they operate their business and how they attract customers.

Internet

Search the Internet using keywords like “business trends” and an industry name. For example, you could Google “business trends beauty salons” or “business trends food trucks.”

Here are some specific websites with information about industry data:

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Chapter Review

This chapter began with an overview of the business plan sections. Business plans usually include an executive summary, business description, marketing plan, operations plan, and financial plan.

The different parts of the Business Description section include:

- Company Description

- Business Background

- Owner Qualifications

- Type of Ownership

- Business Industry Description

Prepare

Use the information in this chapter to put together a draft of the Business Description section in the Business Plan Outline (which you may have already downloaded and saved at the beginning of this chapter). Save the document so you can continue to fill it out as you develop your business plan in later chapters.

- Start by writing your company description and business background.

- Talk to your VR counselor, a benefits counselor, and other business experts about ownership types and what might be the best fit for you.

- Research your business’s industry and write up what you find.

- Make a note of questions you have or help you may need. Share your questions and Business Plan Outline with your VR counselor.

Writing your business plan will take time, often several months or even a year. But if you put in the time and research now, you will improve your chances of success in the future.

VR Counselor Tips

Business Development Resources

Writing a complete business plan can be time-consuming. Many people benefit from having a business mentor or other business development advisor during the process. The counselor can help the consumer by connecting them with local and national resources:

- Small Business Development Centers (SBDCs) offer free business consulting and low-cost training to help with business plan development.

- Your town or a nearby university may also have a small business incubator that could help you find resources for starting a business.

- SCORE Association members are trained business advisors who offer free business advice via email, face-to-face appointments, online workshops, and e-newsletters.

- Women’s Business Centers provide training and counseling for economically disadvantaged women.

- Veterans Business Outreach Centers provide business development assistance to veterans.

More information can be found in “Chapter 8: Resources.”

Other Resources

The counselor can suggest other resources that might be available in the community.

- If the consumer lives near a college with a business school, the consumer could reach out to see if a student could help develop their business plan. Sometimes business students are required to do class projects and may be looking for local small business owners to help.

- The consumer could approach a local business owner in a similar business to see what resources they used to start their business.

Owner Capacity

- The counselor should consider the consumer’s capacity to run their own business and how the VR program can help them prepare. What gaps need to be addressed?

- What training or support is available?

Ownership Types

The counselor may have some information to share about ownership types.

- Which ownership types does the VR agency usually support?

- Does the consumer’s business idea fit within one of these business types?

- How will this business type potentially impact the consumer’s benefits (SSI, SSDI, or healthcare)?

- Has the consumer talked with a benefits counselor?

Industry Trends

The counselor should consider the industry and scope of the proposed business.

- For the consumer’s proposed business, are there challenges to business start-up that will make it unlikely the business will succeed?

- Are there other products or services that the consumer could also offer as part of their business?

- Are businesses in this industry run by individual owners?

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Check Your Understanding:

Assessing the Business Plan

This section helps you check your understanding of the material covered in this chapter. You can also apply what you have learned by reviewing business scenarios for Shane and Brent below.

Business Plan Questions

Write down answers to the following questions about the Executive Summary and Business Description portions of the business plan.

- What are three reasons writing a business plan is a good idea?

- What is the purpose of the executive summary and when should you write it?

- What information is included in a company description?

- Provide a 1-3 sentence example.

- What are three things to include in the business industry description?

Open the “Review Your Answers” accordion below to compare your answers.

Review Your Answers

Business Plan Benefits

What are some reasons writing a business plan is a good idea?

- It helps you think about business decisions before you open your business.

- It helps you understand other similar businesses.

- It helps you think about what you need to do to get your business up and running.

- It gives you a document that can be shared with others so they can give you feedback and advice.

- It provides information you’ll need to share with people who may help fund your business, such as banks and investors.

Executive Summary

What is the purpose of the executive summary, and when should you write it?

- You use the executive summary to convince your counselor, VR agency, and banks or lenders that your business is worthwhile. Often, banks or lenders use the executive summary to decide if they will read the full business plan.

- You should write the executive summary after you have completed the other sections of the business plan because it summarizes information covered in all the business plan sections. However, it is the first section presented in the business plan.

Company Description

What information is included in a company description? Provide a 1-3 sentence example.

The company description is a short 1-3 sentence statement that describes the business. It includes:

- The business name

- A short description of the products or services the business provides

- The target customers

Company Description Example:

Lawn Man Maintenance provides mowing, edging, pruning, and landscaping services to homeowners.

Business Industry

What are some things to include in the business industry section of the business description?

- Different types of products or services offered by other similar businesses

- How much money similar businesses make

- If sales vary due to seasonal or economic changes

- How similar businesses advertise their services or products to customers

- Challenges that may make it hard to start a business in this industry

- How technological trends, changing customer tastes, or demographic changes are affecting the industry

Scenario 1: Shane

Shane lives in Montana. He wants to start a business, Beartooth Mountain Knives, that makes different kinds of outdoor knives.

- He has been making knives since he was in high school. He learned from his grandfather, who made knives for decades.

- He will make his knife handles out of local and exotic wood, as well as deer and elk antlers.

- He also plans to offer knife sharpening and repair.

- Shane already has the specialized tools, forge, and workspace that he needs. He uses a wheelchair, and the space is already set up to accommodate his needs.

- He has sold a few knives on eBay in the past, but wants to make his own website.

- Shane has talked to a local hunting shop and a local gift shop, and both owners said they would sell his knives in their stores.

- Shane knows another knifemaker who lives a few hours away, but he only makes two different types of knives and only uses deer antlers for handles. Shane and the other knife maker are friends, and they share techniques with one another. His friend said that he has had to turn potential customers away because they want custom knife types that he doesn’t make.

- Shane follows a few other knifemakers on social media, and he knows several members of the Montana Knifemakers Association, whom he plans to talk with about the industry.

- Shane has talked with other local business owners and thinks that a sole proprietorship would work best for him.

Based on the information provided, write a draft company description for Shane’s business. Then, think about what other information he will need to begin writing his business description for the Business Background, Owner Qualifications, Type of Ownership, and Business Industry Description sections.

Open the “Shane’s Business Description” accordion below to compare your answers.

Shane’s Business Description

Shane’s Company Description

Beartooth Mountain Knives makes unique, custom outdoor knives for those seeking high-quality tools tailored to their needs. We also provide repair and sharpening services to keep your knives at their best.

Shane’s Business Background

Shane has shared what he’s accomplished so far for his business and how his knives are different from other similar businesses, but he should share more about what led to his business idea and the gaps or needs that his business fills. For example, what is motivating him to turn his knife-making skills into a business?

Shane’s Owner Qualifications

Shane has the skills and background to make knives and has some business experience selling his knives on eBay. His space is already set up to accommodate his disability. He needs to highlight any management experience he might have in running a business and should mention if he has any business mentors or other resources to help him run his business. He can potentially enlist his friend to become a business mentor.

Shane’s Type of Ownership

Shane thinks that a sole proprietorship would work best for him, but he should also check with a small business development expert to learn more.

Shane’s Business Industry Description

Shane has done some research and can ask his friend and members of the Montana Knifemakers Association other questions about the industry. He needs to have a better idea of how many knives are typically sold by individual sellers, what people pay for quality knives, and how they advertise and attract customers.

Scenario 2: Brent

Brent loves playing board games. He gets together with his friends every week to play different games. He wants to start a business, Brent’s Board Game Room, where people can come play games, eat snacks, and hang out.

- Brent has an extensive collection of games that he would have for customers to play.

- He plans to have a space with large tables so people can come and play different types of games. He wants it to be a place where everyone in the community can come, hang out, and make friends.

- Brent wants to be open in the afternoons, so school kids have a safe place to come hang out, and in the evenings, so adults can come after work.

- He plans to also have drinks and snacks for sale so that people will be encouraged to stay longer.

- Brent thinks that maybe he could offer classes on how to play different games, if customers are interested, or could form an after-school kids’ gaming club. He plans to have events featuring multi-player games, where people who are interested can show up and join other people to play, instead of needing to come with their friends. He also plans to hold tournaments, where teams can enter to play one another.

- He doesn’t know of any spaces dedicated to playing games in his area. The community center has big tables, but the space isn’t always available.

- He found a good space to rent that is accessible, clean, and next door to his brother’s accounting business.

- Brent has some difficulties paying attention to small details and keeping track of things like paperwork. His brother offered to help him get his business organized and will check in every week, and as needed, to make sure Brent isn’t overlooking anything important.

Based on the information provided, write a draft company description for Brent’s business. Then, think about what other information he will need to begin writing his business description for the Business Background, Owner Qualifications, Type of Ownership, and Business Industry Description sections.

Open the “Brent’s Business Description” accordion below to compare your answers.

Brent’s Business Description

Brent’s Company Description

Brent’s Board Game Room will be a family-friendly gathering space for people of all ages to come together and have fun. Customers can bring their own game or play one of ours, buy drinks and snacks, and meet new and old friends.

Brent’s Business Background

Brent has already shared information about what led to his business idea and the need it will fill. He doesn’t think there are any similar businesses nearby, but he should check. Since he will not be able to charge very much for people to come to the space to play, his business is mostly focused on selling snacks and organizing game tournaments. He will need to address these in his business background section.

Brent’s Owner Qualifications

So far, Brent hasn’t shared any information about his training or experience with running a business. His brother will help him, but Brent will need to explain his own experience and background. For example, he will need to think about available resources to help him get his business started and learn how to advertise and attract customers.

Brent’s Type of Ownership

Brent will need to decide on the best form of ownership for his business. He should discuss this with a small business development expert and a benefits counselor.

Brent’s Business Industry Description

Brent hasn’t done any industry research and will need to do so. He needs to learn about potential customers and how he might be able to reach them, how much demand there might be for his business, expected costs and profits, and any challenges he could face.

Use the “Return to tabs” button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.